The Strategy Flywheel Diagnostic: Spot the Stall That Unlocks Momentum

Work backward to accelerate forward.

It’s strategy review time.

You're pulling together slides, aligning priorities, prepping the all-hands.

As you look through the details you realize:

Your team ships constantly but nothing compounds.

New features launch. Priorities shift. Meetings multiply. But strategic momentum? Flat.

The symptoms are everywhere:

Your team can’t mobilize around strategy (people problem)

Your metrics stay flat despite activity (performance problem)

Your processes depend on talent instead of design (process problem)

Your priorities scatter across too many bets (prioritization problem)

These look like separate problems requiring separate fixes.

They're not.

It’s one problem showing up in multiple places. And it’s not where you think it is.

I ran an exercise with 14 growth-stage CEOs.

The opener was 3 simple questions:

What are your Q3 priorities?

How does your go-to-market process work?

What transformation do customers experience through you?

The results:

12 could list Q3 priorities clearly

5 could explain their go-to-market process

2 could state the transformation in one sentence

Here’s what got interesting.

The 2 who could articulate transformation? Their priorities made sense. Their processes ran without heroes. Their teams mobilized without constant alignment meetings.

The 12 who couldn’t? Scattered priorities. Process confusion. Teams that needed everything explained twice.

Same talent levels. Same market conditions. Same access to capital. Different clarity on one question.

One CEO—call him David—could describe his company’s priorities for fifteen minutes. Detailed. Specific. Market segments, product features, competitive positioning against three named rivals.

When I asked the transformation question, he paused.

“We help companies... operate more efficiently? Scale their teams?” Each answer rose at the end. Questions, not statements.

His company was growing. Revenue up 20% year over year. But something was eating into his profits. Sales cycles kept lengthening. Marketing couldn’t explain why customers chose them over alternatives. The product team had three roadmaps depending on which executive you asked.

David thought he had three separate problems: sales training, marketing messaging, product alignment.

In reality, he had one problem showing up in three places.

Each leader had built their function around whichever version they’d heard most. Sales trained on efficiency. Marketing wrote about scale. Product built for automation. They were all executing well—on three different strategies.

So David ran the diagnostic with his leadership team. They started with People—could the team articulate the transformation? Sort of. Sales described it as efficiency. Marketing called it scale. Product said automation.

They traced backwards. Performance metrics were scattered—each team measured success differently. Process required constant executive intervention. Priorities included eleven strategic initiatives for a sixty-person company.

Then they hit Positioning.

David had three different transformation stories. One for investors (efficiency platform). One for enterprise customers (scale solution). One for mid-market (automation tool). He’d optimized messaging for each audience without realizing his team had absorbed the ambiguity.

Six months later, David told me the sales cycles shortened. Not because they fixed sales. Because positioning clarity gave everyone the same transformation story to execute against.

The symptoms showing up downstream—people, performance, process, prioritization—weren’t the problem. They were the signal. The source was upstream.

Every breakdown traced back to the same place: unclear transformation ownership.

If unclear transformation ownership caused downstream breakdowns, there had to be a sequence—a chain of dependencies where clarity either flowed or stopped.

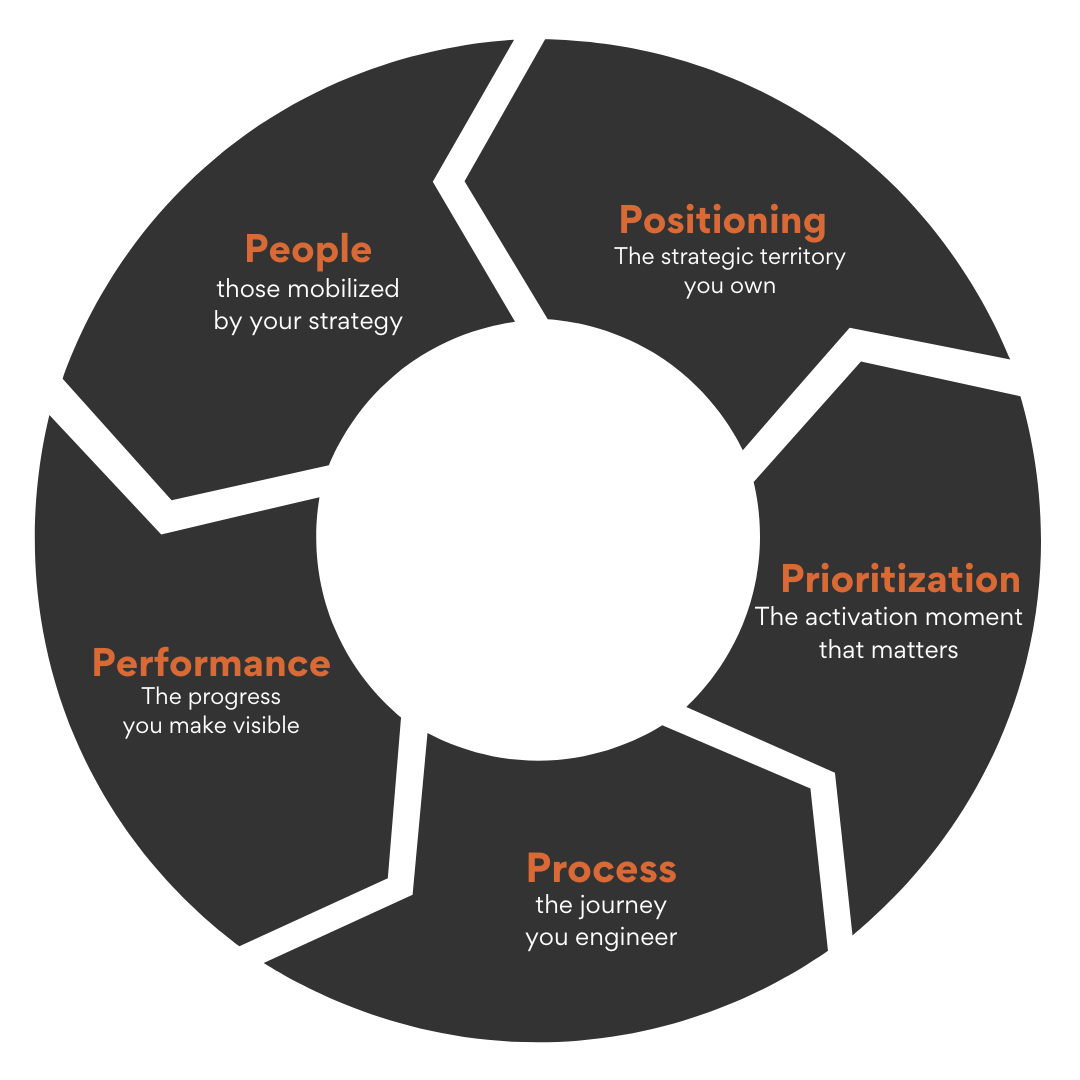

That’s the Strategy Flywheel. Five elements, each dependent on the one before it:

Positioning → Prioritization → Process → Performance → People

Here’s the chain:

Positioning: What transformation do you own? (The upstream source)

Prioritization: What deserves focus given that transformation?

Process: How do you systematically deliver that transformation?

Performance: How do you measure transformation progress?

People: Who needs to move, and can they articulate why?

Priorities make sense when positioning is clear. Processes work when priorities are focused. Performance metrics matter when processes are designed. People mobilize when they can see the whole picture.

Break clarity anywhere in the chain, and everything downstream shows symptoms.

This is why the 12 CEOs had scattered priorities. It wasn’t a prioritization problem. Their positioning was unclear, so every priority seemed equally valid. No filter.

This is why their processes required heroes. It wasn’t a process problem. Their priorities scattered, so processes couldn’t be designed around a clear outcome.

The symptoms were real. The diagnosis was wrong.

The Flywheel doesn’t just describe what’s broken. It reveals where clarity broke down. And that changes where you put your attention.

How to diagnose your Flywheel?

Work backwards.

Start where the pain shows up. Trace upstream until you hit resistance. That’s where clarity broke down.

The method:

Start with People.

Ask: “Can your team articulate what transformation you own and why it matters?”

If yes, clearly and consistently, your People element is solid. Move upstream.

If the answer is “sort of” or “depends who you ask”—stop. You found a symptom. But it’s not the source yet.

Second-level: Who tells it most clearly? What do they know that others don't? That's your clue—clarity exists somewhere but hasn't been distributed. Find the person who gets it and map what they understand that others are missing.

Keep tracing.

Move to Performance.

Ask: “Are you measuring transformation progress, or just activity?”

Dashboards full of metrics that don’t connect to customer transformation? Performance is showing symptoms. But why?

Second-level: When did you last change what you measure? If metrics multiplied recently, that's often a signal—teams adding measurements because no one agrees what actually matters. Find when the dashboard bloat started. Something upstream shifted around that time.

Keep tracing.

Move to Process.

Ask: “Do your processes systematically deliver transformation, or depend on heroic effort?”

If every win requires someone going above and beyond, your Process element is strained. But is Process the source, or inheriting symptoms?

Second-level: Who are your heroes? What do they do that processes can’t? Often heroes are compensating for upstream ambiguity—they’ve figured out something about priorities or positioning that hasn’t been made explicit. The hero’s workaround reveals where clarity broke down.

Keep tracing.

Move to Prioritization.

Ask: “Do your priorities focus resources on transformation, or scatter across competing bets?”

If everything feels urgent, if the strategic plan has 15 initiatives, if teams can’t say what’s not a priority—Prioritization is strained. But why can’t you prioritize?

Second-level: What got cut last? If nothing gets cut, or cuts feel arbitrary, that's a positioning signal. Clear positioning creates natural filters—some things obviously serve the transformation, others obviously don't. When everything survives prioritization, trace upstream.

Keep tracing.

Arrive at Positioning.

Ask: “Can you state in one sentence what transformation customers experience through you?”

This is the headwaters. If you can’t answer clearly, nothing downstream can compensate. Priorities scatter because there’s no filter. Processes improvise because there’s no destination. Metrics multiply because you’re measuring everything hoping something matters. Teams fragment because they’re each solving for their own version of success.

Second-level: Ask three different leaders the same question. If you get three different answers, you've found the source. The variation isn't a communication problem—it's a clarity problem. Each leader built their downstream work on their own version of what the company owns. That's why nothing aligns.

The "Sort Of" Signal

Here’s what to listen for as you trace backwards: the “sort of” answer.

“Can your team articulate the transformation?” “Sort of. Marketing says it one way, Sales says it another.”

“Are your processes designed or heroic?” “Sort of. We have processes, but they flex depending on the situation.”

“Sort of” means clarity exists somewhere—in a founder’s head, in an old deck, in tribal knowledge—but it hasn’t been distributed. The element works sometimes, for some people, in some contexts.

That’s the breakdown point. Everything downstream from a “sort of” runs on improvisation instead of infrastructure.

What “Sort Of” Looks Like at Scale

Apple had what every competitor was trying to build.

Siri wasn’t a voice assistant sitting on top of the iPhone—it was woven through the entire ecosystem. Thirteen years of users learning they could ask anything without their voice becoming a product. Billions of interactions reinforcing trust. Every device you added made it more valuable. Watch knew your fitness. HomePod knew your routines. iPhone knew your communication patterns. Siri connected all of it.

On-device processing. Privacy as positioning. Integration competitors couldn't replicate—not without abandoning the business models that funded their AI development.

OpenAI had intelligence but no integration. Google had reach but no trust. Amazon had presence but no coherence.

Apple had all three.

Then ChatGPT launched. And Apple blinked.

Instead of deepening what they owned, they built something new. “Apple Intelligence”—positioned as different from Siri. Development teams created separation instead of integration. Marketing spent $1 billion teaching customers a new name for what they already trusted. Product teams explained how this was different from what customers already had.

The positioning went from clear to “sort of.”

Do we own AI? Sort of. We have Siri, but we’re also building Apple Intelligence... Is Siri still our thing? Sort of. But Apple Intelligence is the future... Should customers trust the old or learn the new? Sort of both...

That hesitation cascaded through every system. Teams mobilized around the wrong war. Metrics chased ChatGPT’s scorecard instead of ecosystem value. Processes fragmented. Priorities scattered.

The downstream symptoms looked like execution problems. Delays. Pulled ads. Features that didn’t work. Emergency partnerships with Google.

But the source was upstream. Apple’s positioning went from owned to “sort of”—and everything downstream paid the price.

Two billion dollars later, they’re renting capability they once owned.

The diagnostic would have caught it. Trace backwards: People can’t mobilize → Performance metrics don’t connect → Processes require heroes → Priorities scatter → Positioning is “sort of.”

That’s where the work starts.

Other “Sort Of” Patterns

Apple isn’t unique. The pattern shows up everywhere transformation ownership gets fuzzy.

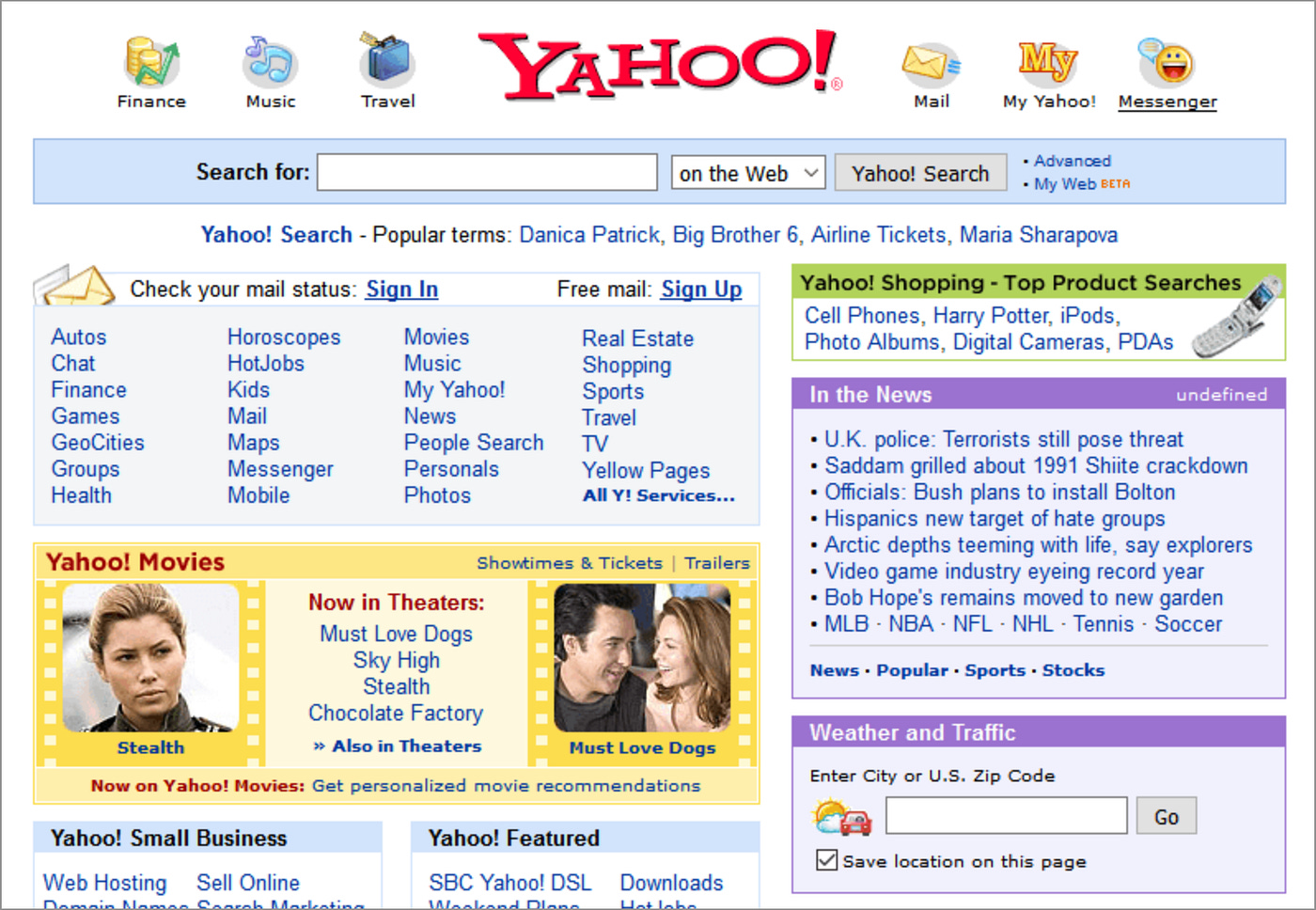

Yahoo owned the internet directory—the way people navigated the early web. Then Google arrived with a different transformation: search. Yahoo’s positioning became “sort of.”

Are we a directory or a search engine? Sort of both.

That hesitation cascaded through everything. They spent $2 billion acquiring search technology. Built Yahoo Search. Hired top talent. Still couldn’t compete. Why?

Trace backwards: Development teams built for unclear positioning. Marketing couldn’t explain what made Yahoo different. Processes served competing visions. Priorities scattered across search, email, social, content—everything seemed equally important because nothing was clearly owned.

Eventually, Yahoo surrendered. They licensed Bing’s search technology—becoming a renter to Microsoft’s renter. A company that once rejected buying Google for $1 million now pays to use a competitor’s competitor.

96% value destruction. $125 billion to $4.8 billion. The symptoms looked like execution problems. The source was upstream.

BlackBerry owned mobile email transformation—the device business professionals trusted with secure, push email before smartphones existed. Then iPhone redefined the category as consumer platform.

BlackBerry’s positioning became “sort of.”

Are we enterprise security or consumer smartphone? Sort of both.

They spent billions on BB10—a technically competent operating system that launched six years too late. They tried Storm touchscreens, PlayBook tablets, consumer apps. Each attempt strained resources and confused the market.

Trace backwards: Teams couldn’t agree what transformation BlackBerry owned. Product roadmaps served competing visions. Marketing oscillated between enterprise and consumer messaging. Every priority seemed valid because positioning was “sort of.”

Market share collapsed from 50% to 3%. Not because the technology failed—because clarity never existed at the headwaters.

The diagnostic would have caught it. All three companies had brilliant talent, massive resources, and market position. All three lost because downstream symptoms got treated while upstream ambiguity compounded.

Why does working backwards reveal what working forwards misses?

Think about the doctor you trust.

Not the one who scribbles a prescription before you finish describing symptoms. The one who asks questions. Who traces backwards through your history, your habits, your context—until they find where the problem actually started.

You come in with headaches. A rushed doctor prescribes painkillers. Headaches return. Stronger painkillers. Side effects. More symptoms.

The doctor you trust asks different questions: When did they start? What changed? What else is happening? They trace backwards through sleep, stress, diet, posture—until they find the upstream cause. Maybe it’s tension from a workspace change six months ago. The headaches were real. The painkillers weren’t wrong. But they were treating downstream.

Fix the workspace. Headaches resolve. No medication needed.

That’s the difference between symptom treatment and source diagnosis.

The rushed doctor treats what’s visible. The trusted doctor traces what’s connected. Same patient. Same complaint. Different intervention points.

Here’s what the trusted doctor understands: symptoms show up where they’re felt, not where they start. The headache is in your head. The cause might be in your neck, your schedule, your screen time, your stress. Treat the headache, you get temporary relief. Find the cause, the headache stops needing treatment.

The Strategy Flywheel works the same way.

Positioning is the source. The transformation you own.

That clarity flows into everything else: Prioritization. Process. Performance. People.

When the source is clear, downstream systems work—not because they're perfectly designed, but because they're not compensating for ambiguity. Same people. Same resources. Same processes. Different results.

When the source is unclear—when positioning is "sort of"—every downstream system absorbs the strain:

Priorities multiply because no one owns the filter

Processes improvise because outcomes keep shifting

Metrics scatter because no one agrees on what success proves

Teams fragment because each group optimizes for a different version of winning

The symptoms are real. The pain is real.

But downstream teams aren’t broken. They’re absorbing ambiguity they didn’t create.

This is why hiring better talent doesn’t fix a people problem. Why new dashboards don’t fix a performance problem. Why documented workflows don’t fix a process problem. You’re prescribing painkillers for a workspace issue.

Working backwards traces the connection until you find where clarity failed. That’s the intervention point.

Clear the source, and you don’t fix execution. You remove the need to compensate for it.

Your turn.

Where’s the stall showing up right now? People? Performance? Process? Prioritization?

Start there. Trace backwards.

At each element, ask: “Is this clear, or sort of?”

When you hit “sort of,” you’ve found the breakdown point. Everything downstream from there isn’t failing—it’s compensating.

That’s where the work starts. Not with better dashboards. Not with communication training. Not with another offsite.

With clarity at the source.

One question to try this week: Pick the symptom that’s frustrating you most. Ask yourself—what would need to be true one level upstream for this problem to dissolve on its own?

If you can’t answer clearly, keep tracing.

PS - If you want the forward view—how to build the Flywheel from Positioning through People—start here: The Strategy Flywheel: How Strategic Clarity Compounds Into Momentum