When Category Owners Join Forces: The YETI x Liquid Death Strategic Fusion

The Prime Positioning win every strategy leader should study

“Wait, these two are friends?”

Picture the scene: It’s the day of the company holiday party. The creative team just crushed their biggest presentation of the year - the one where leadership finally said “Holy sh*t, they can actually execute.”

That evening, at the party, something unprecedented happens. The creative team is sitting at the executive table. And when the VP walks in, instead of straightening ties and switching to corporate-speak, something else happens.

The VP loosens their tie and sits down.

Both sides start laughing together.

Wait. The CREATIVE team is sitting with EXECUTIVES? And the VP is actually JOINING them instead of maintaining professional distance?

The “creative team” was Liquid Death - the category owner who created the $1.4 billion punk-rock canned water category.

The “VP” was YETI - the category owner who defined the $1.7 billion premium outdoor cooler category.

What they created together was a casket-shaped cooler that sold for $68,200 at auction.

When the hammer fell at that price - with 810 people bidding luxury car prices for a cooler shaped like a coffin - the marketing world had the same reaction as that office party moment:

“Wait, these two are friends?”

Here’s the story of how two category owner achieved strategic fusion that neither could execute alone.

How They Become Category Owners

Before YETI could loosen its tie at the party, it had to earn vice-presidential credibility. Before Liquid Death could sit at the executive table, it had to prove it could execute.

The strategic fusion only worked because both had already done the hard work that made risk feel safe.

YETI: The Discipline That Built Permission to Play

Founded in 2006 by Roy and Ryan Seiders, YETI began as a revolt against disposable gear. Their first audience—hunting guides and fishing captains—measured value in survival, not aesthetics. Every cooler had to pass the guide test: would a professional stake their livelihood on it?

For fifteen years, YETI protected one asset—engineering credibility.

That discipline became a moat. Buying a YETI meant buying into a transformation: I’m serious about what I do outdoors.

As the brand scaled, “serious” extended from guides to weekend warriors to backyard hosts. By 2020, their competence was so established that playfulness no longer threatened it.

Liquid Death: The Execution That Earned Respect

Launched in 2017 by Mike Cessario with $1,600 and a middle finger to sterile wellness branding, Liquid Death turned water into rebellion. Their test was cultural, not mechanical: the punk test—would this make the disaffected laugh instead of cringe?

For seven years, they protected entertainment authenticity.

That commitment built a cultural moat. Buying Liquid Death meant buying into a transformation: I reject corporate boredom.

Then they did what entertainment brands rarely manage—proved it works. From viral stunts to a $1.4 billion valuation, they showed that parody could drive real performance. By 2023, premium brands sought them out for their ability to turn attention into commerce.

The “Impossible” Pairing That Mobilized Audiences

By mid-2024, both category owners had earned credibility in their respective domains—yet their audiences couldn’t imagine them sharing a stage.

YETI loyalists saw Liquid Death as chaotic marketing without craft.

Liquid Death fans saw YETI as establishment gear without soul.

Both asked the same question: “What could my brand possibly gain from working with them?”

The YETI Audience: Following Premium Excellence

Weekend warriors. Tailgaters. Barbecue purists.

People who buy $400 coolers because they know the cost of “good enough.”

Their identity: I follow brands that take quality as seriously as I take my adventures.

Their hesitation: Liquid Death feels unserious—stunts over substance.

Their unspoken desire: Permission to play without betraying performanc

The Liquid Death Audience: Following Rebellious Authenticity

Festival goers. Punk traditionalists. Anti-corporate humorists.

People who buy canned water to make a point, not a purchase.

Their identity: I follow brands that reject corporate posturing and reward irreverence.

Their hesitation: YETI feels like corporate gear for people with too much money and not enough personality.

Their unspoken desire: Permission to care about quality without losing edge.

The Overlap Nobody Expected

When the casket cooler dropped, both groups recognized themselves in the mirror.

YETI’s crowd already used humor to punctuate discipline.

Liquid Death’s crowd already made strategic product choices.

Both wanted what the other represented:

Function that performs and personality that plays

Products that work flawlessly and stories that reflect complexity

The freedom to be serious about what matters without taking themselves too seriously

The collab proved they’d been moving toward each other all along—YETI expanding “built for the wild” into culture, Liquid Death proving entertainment could perform.

What looked like an impossible pairing turned into self-recognition.

When people said, “Wait—these two are friends?”

what they really meant was, “Maybe I can be both, too.”

The Progress They Made Visible

Compatibility doesn’t move markets. Proof does.

Both category owners needed to show that strategic fusion could create value—real, measurable, luxury-tier value.

The Innovation: A New Consumption Occasion

The casket cooler didn’t just combine two products. It created a consumption occasion that neither brand owned alone: premium spooky entertaining.

Not Halloween or tailgating—Halloween with YETI-grade engineering.

Death humor plus functional excellence. YETI-level build applied to Liquid Death-level spectacle.

The media recognized it instantly:

“Revolutionary beverage cooler.”

“Most overengineered joke in beverage history.”

“Killing the internet.”

A category was born in real time.

Market Proof

The auction became a live experiment: Is there demand for serious quality applied to playful concepts?

The answer was conclusive.

810 bidders — depth of demand

$68,200 final price — 45× starting bid

Twenty-day run — sustained engagement, not flash virality

Luxury-tier pricing — identity performance turned into market value

The buyer didn’t just purchase a cooler; they purchased a symbol—someone serious about quality and unserious about self-importance.

1.2 billion press impressions turned that act into social proof. The story validated a new behavioral category: functional excellence meeting cultural irony.

The casket cooler wasn’t a stunt; it was measurable traction. The market confirmed what the collaboration proved—clarity of role can create value no one had priced before.

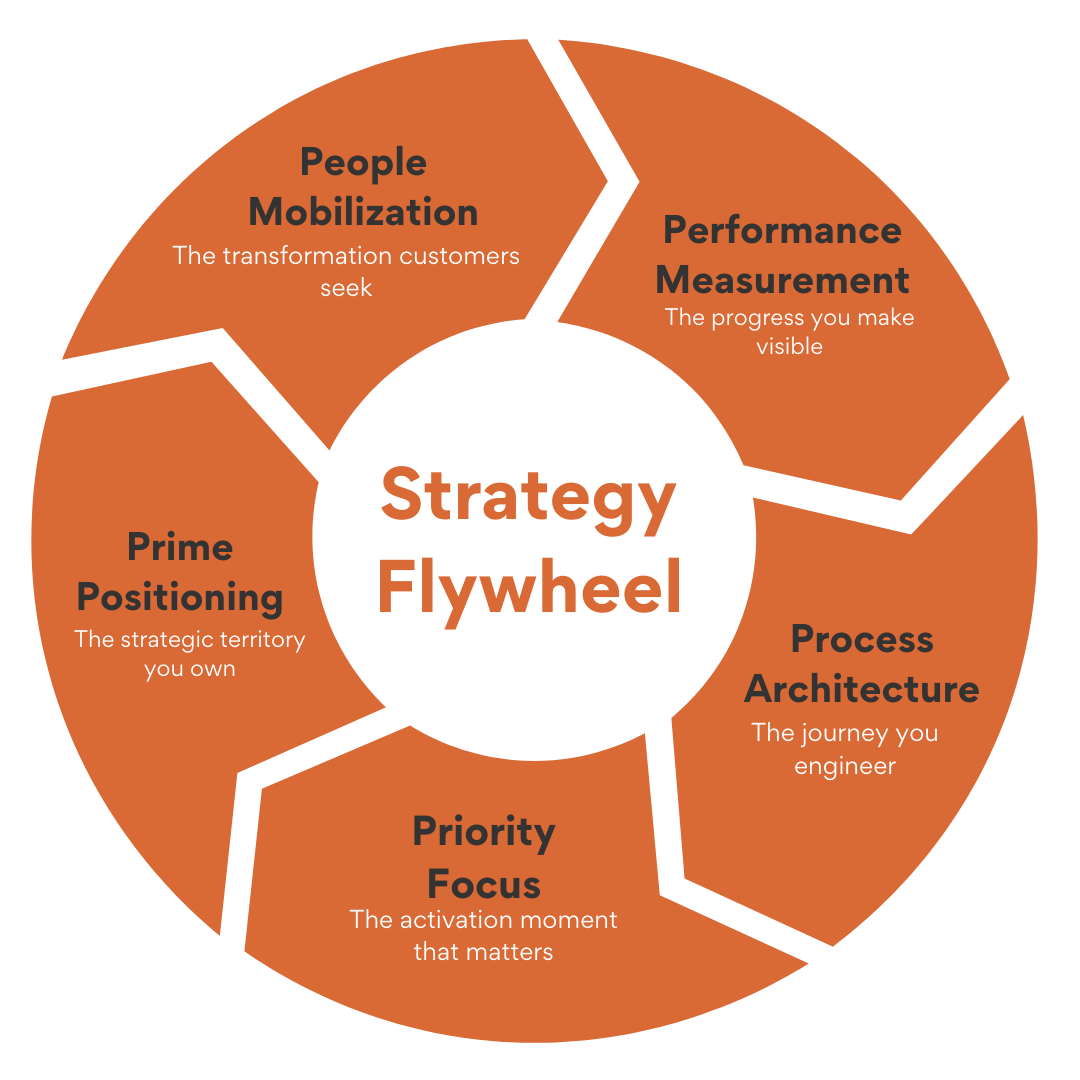

The Mechanics of Integration for YETI & Liquid Death Through The Strategy Flywheel™

How did two category owners with opposite strengths actually build something together? Each controlled their strength domain.

Integration Mechanics

YETI Anchored the build:

Manufacturing precision, ColdCell engineering, and uncompromising quality standards turned a novelty into a functioning 85-pound cooler. Their credibility grounded the absurdity—proof that craftsmanship could coexist with humor.

Liquid Death Amplified the Narrative:

Creative direction, media strategy, and deadpan entertainment transformed the cooler into a cultural artifact. Their humor served the story; the campaign operated as a system for earned media, not an ad.

Neither crossed domains. YETI stayed serious about build integrity; Liquid Death stayed unserious about everything else. The tension became the collaboration’s power source.

Risk & Reward Architecture

The collaboration was designed for asymmetrical upside and controlled exposure.

Single product: limited edition, no ongoing obligation

Market-set pricing through auction: no internal conflict

If reception failed, both could walk away cleanly

Each protected its core:

YETI never diluted quality; Liquid Death never sanitized tone.

Together, they maximized impact with minimal cost—shared production, viral return, $11.5M in earned media, and a 500%+ estimated ROI.

Mutual Market Access

Each gained access to markets it couldn’t reach alone.

YETI Gained:

A social-first distribution engine reaching audiences outside outdoor retail

Festival and concert visibility through Liquid Death’s cultural presence

Credibility with a digital-native demographic that views function through irony

Liquid Death Gained:

Premium retail legitimacy through YETI’s legacy authority

Proof of manufacturing partnership at a luxury standard

Entry into outdoor recreation territory without losing its rebellious edge

Integration as Signal

The collaboration didn’t just blend capabilities—it modeled integration itself.

For audiences, it proved a larger idea: you can be serious about what matters and playful about everything else. That balance of clarity without conformity is what makes Prime Positioning compound.

What Stayed Sacred As a Priority

The collaboration worked because both brands knew exactly what would never move. When you’re clear about what stays sacred, you can be flexible everywhere else.

YETI’s Non-Negotiables

Quality as Doctrine: The casket cooler had to perform as a real YETI—85 pounds of engineering discipline: Triple-Foam ColdCell insulation, 20-gauge steel, hydraulic pistons, dual drain valves. No “prop” products, no shortcuts, no exceptions for virality.

Authenticity of Use: Even within absurdity, it had to function in the wild—just a different kind of wild. Built for tailgates and Halloween parties alike, still true to “Built for the Wild.”

Brand Integrity: YETI advanced its story without bending it. No death humor, no tone pivot, no dilution of craftsmanship. Engineering remained the language, even when the sentence was satire.

Liquid Death’s Non-Negotiables

Entertainment -First Approach: Creative direction never left their hands. The tone stayed deadpan, the humor stayed dark, “Murder Your Thirst” stayed laser-etched. No sanitizing for premium partnership.

Rebellious Edge: They refused to become “respectable.” Punk aesthetic, anti-corporate voice, counterculture stance—all preserved. The joke had to remain theirs, not approved by committee.

Identity Consistency: They didn’t chase YETI’s polish or prestige. The collaboration worked precisely because they didn’t conform; they collided.

The Priority Focus Principle

Most collaborations collapse because one side bends too far to meet the other. Here, conviction created oxygen.

YETI protected quality; Liquid Death protected irreverence.

That protection became permission—to play, to parody, to perform.

The casket cooler wasn’t YETI doing Liquid Death, or Liquid Death doing YETI. It was a third form born from uncompromised clarity—proof that Priority Focus isn’t restraint; it’s the structure that makes creative freedom possible.

The Prime Positioning They Both Earned

When the VP loosened their tie and the creative stayed at the table, both sides proved the same truth: you can evolve without eroding identity. The collaboration didn’t redefine either brand—it revealed what they’d already become.

YETI: Premium Self Awareness

From: premium outdoor coolers for serious adventurers

To: premium outdoor coolers for people who take their gear seriously but not themselves

What YETI Earned:

Permission to reference humor without compromising quality

Younger demographic credibility without alienating loyalists

“Built for the Wild” reinterpreted to include cultural and social adventures

The casket cooler expanded the meaning of “wild.” Engineering remained sacred—only now, wild could mean bonfires and Halloween parties as much as backcountry hunts.

Liquid Death: Entertainment Infrastructure

From: rebellious entertainment brand that happens to sell water

To: entertainment infrastructure platform that other brands pay to access

What Liquid Death Earned:

“Saturday Night Live” positioning—brands perform on their stage

Partnership credibility with premium establishments

A business model where partners fund production while Liquid Death controls creative

The casket cooler revealed the shift from entertainment brand to entertainment system. Liquid Death stopped renting attention; it began franchising rebellion.

The New Category — Serious About Not Being Serious

Together they proved that serious about not being serious is viable strategic territory.

YETI once risked being too serious; Liquid Death, too unserious.

In combination, they demonstrated that craftsmanship and comedy can share the same standard.

Category Traits:

Flawless function (YETI standard)

Genuine entertainment (Liquid Death standard)

Brands that protect quality and personality simultaneously

Consumers who refuse to choose between performance and play

This is earned territory—strategic ground competitors can’t reach without matching the years of conviction each brand invested to get here.

Prime Positioning isn’t just about defending what you own. It’s earning the right to define what comes next.

The Aftermath: What Each Category Owner Did Next

The strategic fusion confirmed what both category owners suspected—they could work together without losing themselves. The real test came afterward: how each would use their newly earned permissions.

YETI: Returned to Core with New Credibility

YETI didn’t pivot toward rebellion. It proved it could, then doubled down on its foundation: premium outdoor gear enabling authentic experiences.

How YETI Used Their Cultural Fluency Permission:

“Built for Generations” Campaign: sustainability and longevity campaign positioning durability as cultural responsibility, appealing to younger eco-conscious buyers.

“Map the Gaps”: 13-ambassador partnership mapping uncharted trails with Google Street View; functional expansion with cultural resonance.

Outdoor Cookware Launch: natural adjacency to their domain, now reaching younger outdoor audiences through earned credibility.

YETI kept its gear-in-the-background storytelling approach—products as enablers of experience. The casket cooler became a cultural proof point, not a pivot.

Liquid Death: Transformed Its Business Model

Liquid Death didn’t chase another viral moment—it operationalized collaboration itself.

By late 2024, over 70 brands were waiting in line to partner. Each paid production costs; Liquid Death supplied its five-person creative engine.

How Liquid Death Used Their Legitimacy Permission:

By end of 2024: 73 brands waiting to collaborate. Partners cover production costs while Liquid Death contributes 5-person creative team output.

The Partnership Infrastructure They Built:

E.l.f. Cosmetics “Corpse Paint”: gothic makeup collab, 12B impressions, sold out in 45 minutes.

Martha Stewart “Severed Hand Candle”: lifestyle crossover proving establishment synergy.

Boost Mobile “Cellphone Bill” (September 2025): horror-comedy on hidden fees.

Kylie Kelce “Kegs for Pregs” (March 2025): still-water campaign for moms.

“We’re very much an influencer,” said SVP Dan Murphy. Liquid Death evolved into the Saturday Night Live stage of commerce—brands perform, they produce.

Results: 30B earned impressions on <$2M spend; revenue up from $263M (2023) to $333M (2024).

The “Laughing Together” Moment

YETI to Liquid Death: “You proved we can reach Gen Z without becoming Gen Z.”

Liquid Death to YETI: “You proved we can partner with establishment without becoming establishment.”

Both: “We got exactly what we came for—completely different, perfectly complementary.”

That’s the mark of a Prime Positioning partnership: clarity strong enough to play—and alignment tight enough to win.

Why Most Brands Will Fail at This (And What Strategic Thinkers Can Learn)

Most brands will try to replicate YETI × Liquid Death and fail—not because the framework is flawed, but because they’ll skip the discipline that made it possible.

Collaboration magnifies positioning. If the foundation is weak, amplification becomes exposure.

The Three Failure Modes

1. Weak Positioning, Strong Imitation

Brands without Prime Positioning see collaboration as a shortcut to relevance. But if you’re not worth partnering with, no partnership can save you.

Symptoms:

– Borrowed signals from competitors

– No defined customer transformation

– Identity that shifts under pressure

– Relevance sought through association

Collaboration doesn’t fix positioning. It only makes clarity—or the lack of it—visible.

2. Symmetric Competition, No Asymmetry

Most collaborations fail because both parties want the same thing. Two brands chasing identical outcomes divide the same audience.

Symptoms:

– Overlapping customer bases

– Shared goals instead of complementary ones

– Competition disguised as cooperation

When both partners seek identical wins, you’re not combining leverage—you’re splitting attention.

3. Core Compromise, Identity Loss

Brands confuse flexibility with surrender. They adjust to fit instead of aligning to complement.

Symptoms:

– Diluting brand DNA for compatibility

– Abandoning loyal audience for novelty

– Trading long-term conviction for short-term clicks

The brands that protect their non-negotiables most fiercely create the most valuable collaborations.

The Strategic Collaboration Framework

For the few brands strong enough to attempt true fusion, collaboration is not a marketing tactic—it’s a decision system. The framework below defines the conditions that must exist before any partnership creates compounding value.

1. Universe Compatibility Check

Both partners must have earned the flexibility to meet without distortion.

– Can each collaborate without betraying their non-negotiables?

– Are their “universe rules” compatible, not identical?

– Have they each already been moving toward the other’s territory through their own evolution?

Compatibility isn’t similarity—it’s tension that can hold.

2. Asymmetric Permissions Check

Each brand must gain something different from the same act.

– Are they earning distinct advantages from one shared move?

– Does one brand’s progress enable—not dilute—the other’s?

– Do they advance separate strategies rather than share one?

Symmetry divides attention; asymmetry compounds it.

3. Core Protection Check

Identity must remain intact under pressure.

– Does the collaboration amplify, not replace, brand DNA?

– Does the core audience stay served and seen?

– Does long-term positioning strengthen instead of scatter?

The more fiercely you protect your core, the more freedom you earn to play.

When these three conditions hold, collaboration becomes architecture—beliefs linking through design, not luck.

The Category Mover Lesson

Most brands chase speed; category owners build the foundation that makes speed coherent.

The casket cooler happened fast only because both YETI and Liquid Death had spent years earning the right to move that fast.

Category owners understand:

Discipline enables speed. Without structure, momentum turns chaotic.

Positioning enables creativity. Clarity of role liberates expression.

Structure enables flexibility. Boundaries make experimentation safe.

The collaboration’s real proof wasn’t a viral cooler—it was judgment at velocity. Both brands demonstrated that conviction and coordination can coexist, that clarity compounds faster than complexity.

Most will try to skip to the spectacle. They’ll imitate the casket cooler without doing the character work. But the pattern is permanent: positioning before pace, identity before integration, foundation before fusion.

The future belongs to those who move with earned clarity.

Not imitators chasing virality—category owners building systems where creativity and conviction accelerate together.

Most stop at the story. The deeper question is how this collaboration reshaped both category owners’ positioning. What powers are they building? Which disciplines are they mastering? The answers reveal competitive dynamics that extend far beyond one viral product.

The following strategic analysis is based solely on publicly available information, including social media posts, press coverage, and marketing campaigns. It represents an educational exploration of strategic thinking methodology and does not constitute investment advice. The author has no business relationship with Yeti or Liquid Death and may, in the future, consider potential investment or advisory opportunities with companies analyzed.