You know strategy matters. You’ve read the unicorn books - The Amazon Way, Zero to One, the Elon biographies. All inspiring stuff.

Problem is, those stories explain what happened after the fact. You can’t BE Amazon in 2025. You can’t replicate Musk’s circumstances.

So you turn to the classics. The Discipline of Market Leaders. 7 Powers.

These feel more actionable - actual frameworks you can apply to your business.

And you land somewhere familiar:

“We have the most innovative features.”

“We’ll be the best in our category.”

“We just need to execute better than [competitor].”

This is where most strategy journeys end - In the “Better” trap - competing harder on variables someone else defined.

How Strategic Practices Create Power

It’s not that these frameworks are wrong. They describe real advantages. But they’re missing something critical - the sequence that determines whether any of it actually works.

The Discipline of Market Leaders is a classic for a reason. It answers a question every strategist asks: What should we be best at?

The book gives you three choices:

Customer Intimacy - Know your customers deeply. Customize. Build relationships that competitors can’t touch.

Operational Excellence - Be the low-cost leader. Reliable service. Hassle-free experience. Win on efficiency.

Product Leadership - Build the best product. Innovate faster. Outperform on features and quality.

The framework says: pick one to dominate. Maintain threshold performance in the others. Your choice becomes your strategic identity.

Most leaders read this and recognize themselves immediately. “We’re a product company.” “We compete on operations.” “We’re all about customer relationships.”

It feels clarifying. Now you know what game you’re playing.

7 Powers answers a different question: Once you have advantage, what makes it last?

Hamilton Helmer identified seven sources of durable competitive advantage:

Cornered Resource - Exclusive control of a valuable asset: talent, IP, supply, or distribution.

Counter-positioning - A superior business model competitors cannot adopt without harming their existing model.

Network Economies - Value increases as more participants join the network.

Switching Costs - Customers face friction (financial, procedural, or psychological) when changing providers.

Scale Economies - Cost per unit declines as volume increases.

Process Power - Hard-to-copy ways of operating that compound efficiency and effectiveness over time.

Brand - Sustained preference driven by reputation and customer experience, enabling premium economics.

Each power has a specific mechanism that prevents competitors from copying your advantage.

Read both books and you walk away with two useful lenses: what to practice and what makes advantage stick.

But here’s what neither book makes explicit: the practice and the power are connected.

Customer intimacy, done right, creates cornered resources and counter-positioning. Operational excellence, done right, creates scale economies and switching costs. Product leadership, done right, creates process power and brand.

The discipline you practice determines which powers you can build.

That’s the first unlock.

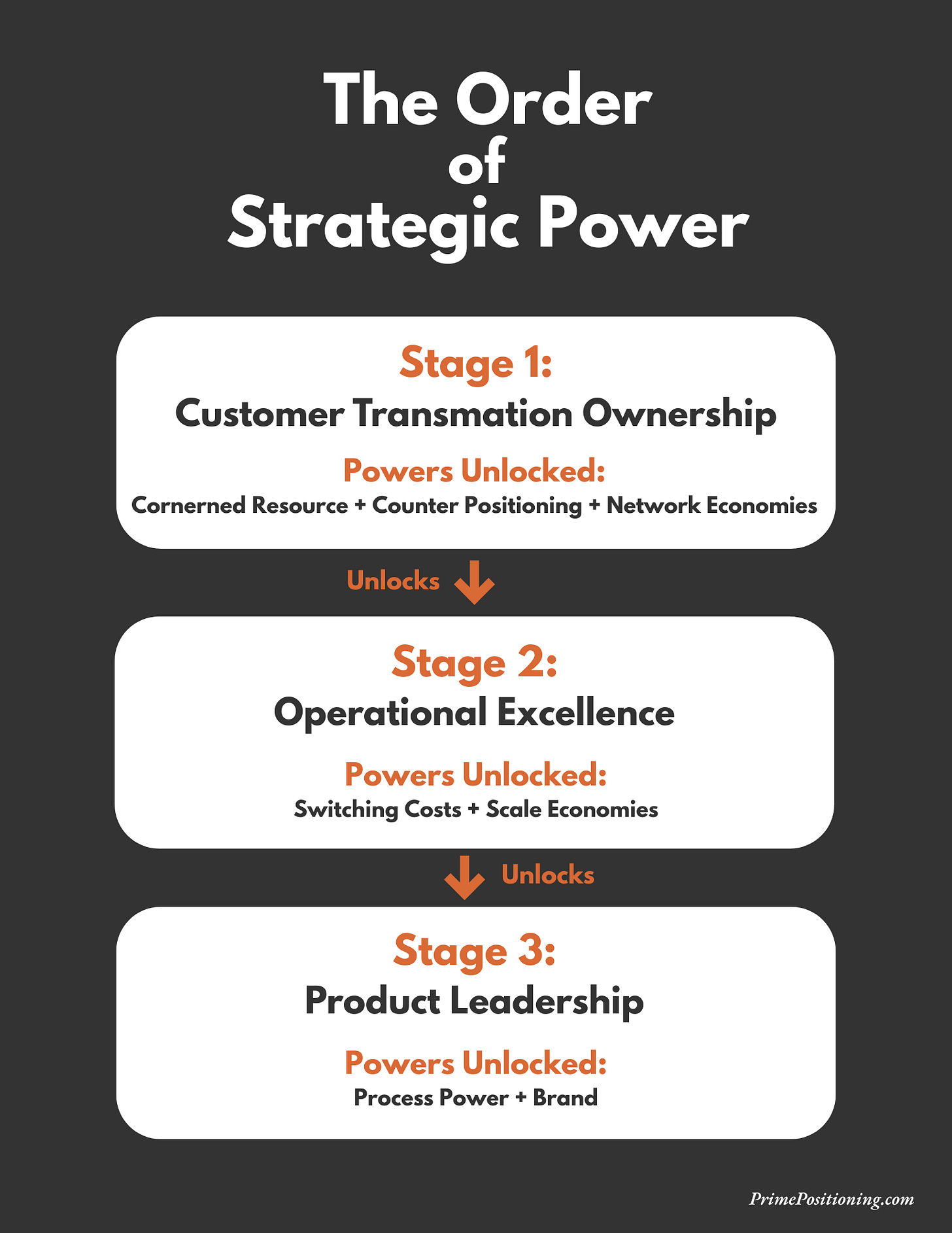

Here’s the second: there’s a sequence.

The Order Positions That You For Advantage

Not all disciplines are equal starting points. Certain powers enable others. Attempting them out of order doesn’t just slow you down - it puts you on borrowed territory, competing on variables someone else defined.

Customer intimacy doesn’t go far enough. That’s necessary, but it’s only half the story.

The companies that build lasting power don’t just understand their customers - they own the transformation story. They don’t just know where customers are. They define where customers are going.

That’s transformation ownership. And it’s the foundation everything else builds on.

Here’s the sequence that unlocks strategic power:

Stage 1: The Practice of Transformation Ownership

Powers Unlocked: Cornered Resource + Counter-positioning + Network Economies

Transformation ownership comes first. Not because it sounds nice - because it’s the only discipline that creates uncopyable assets.

When you own your customer’s transformation story, you own territory. Competitors can copy your features. They can match your operations. But they can’t take your story. That story becomes your cornered resource.

And when you own the story, competitors have to defend against YOUR framing. That’s counter-positioning - they’re playing on your terms, not theirs.

The transformation spreads through word-of-mouth. Customers retell YOUR story. That’s network economies built on narrative, not infrastructure.

This is the foundation. Skip it, and everything you build after sits on borrowed ground.

Stage 2: The Practice of Operational Excellence

Powers Unlocked: Switching Costs + Scale Economies

Once you own the transformation story, you earn the right to invest in operations.

Walmart didn’t start with logistics. Walmart started with “everyday low prices” - a transformation promise to families struggling with budgets. The logistics came to SERVE that promise.

Amazon didn’t start with fulfillment centers. Amazon started with “at your house in days” - a transformation promise that changed what customers expected. The infrastructure came to HOLD that promise.

Build operations on the right foundation and switching costs become real. Customers don’t just lose convenience if they leave—they lose progress toward the transformation you sold them.

And because transformation ownership creates volume, you can justify the massive investment required to win on operations. The scale economies become real because the foundation supports them.

Stage 3: Product Leadership

Powers Unlocked: Process Power + Brand

Only after transformation ownership and operational foundation can you build lasting product leadership.

Product leadership without the first two stages is a feature race. You ship something innovative, competitors copy it in months, and you’re back to competing on price.

Product leadership WITH the first two stages becomes process power - embedded ways of building that emerge from years of serving a specific transformation through proven operations.

That’s how brand stops being descriptive and becomes definitional. The difference between “we make project management software” and “we own calm.”

Attempting stages out of sequence means attempting to build powers you haven’t earned the foundation for.

Ownership Doesn’t Require Scale

It’s easy to look at Amazon and Walmart and think: Big companies can do this. They have resources we don’t.

But the sequence doesn’t require scale. It works whether you’re building a billion-dollar enterprise or a profitable company that never makes headlines.

The clearest examples? Companies most people have never heard of.

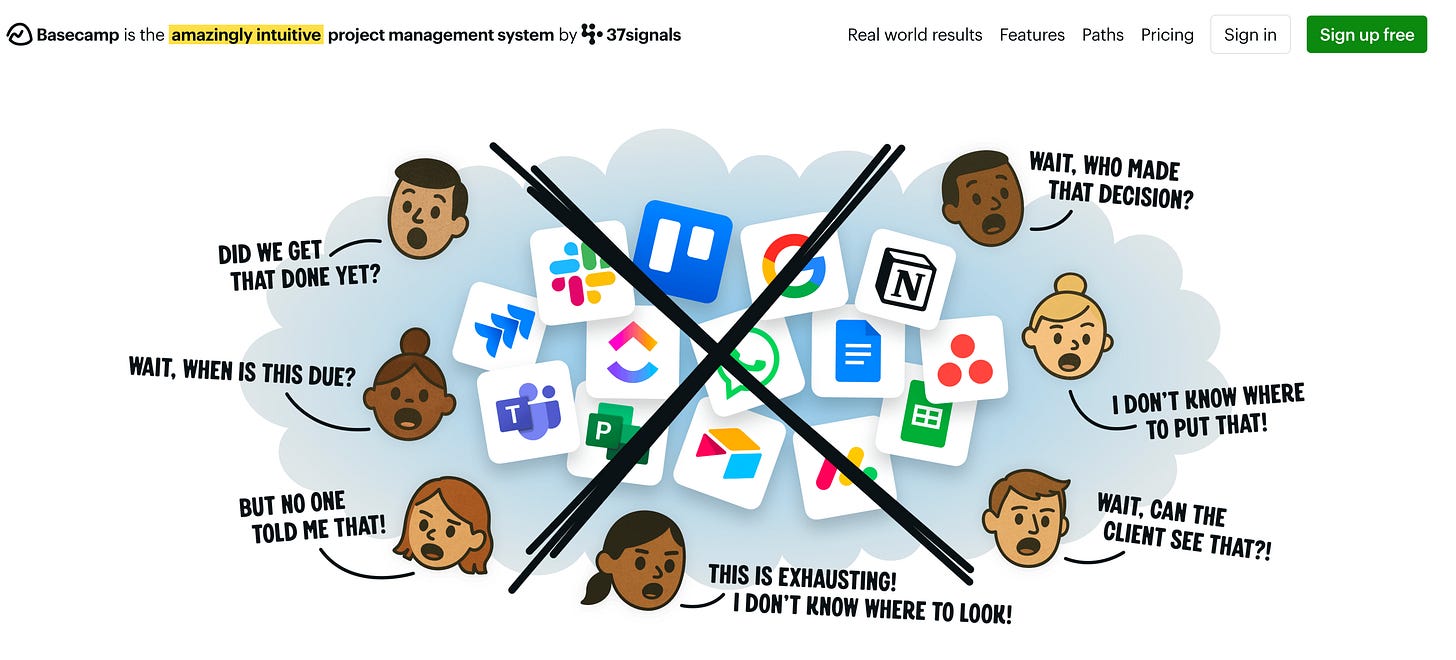

Basecamp’s path to power:

Basecamp is a project management company. They’ve been profitable for 25 years. Zero debt. Privately held. No venture capital. Around 75,000 organizations use their software across 166 countries.

You’ve probably never seen them on a magazine cover.

They started with transformation ownership: chaotic project coordination → “calm, organized way to manage work.”

They didn’t chase enterprise clients. They targeted the “Fortune 5,000,000” - small and mid-size businesses drowning in complexity. Their philosophy: “All we needed and nothing we didn’t.”

They refused to add Gantt charts despite customer demand. Not because they couldn’t build them - because it would violate the transformation story. Calm doesn’t come from more features. Calm comes from fewer.

That’s Stage 1. They owned the territory.

Then they built operations to serve it - reliable, simple infrastructure that delivered on the promise of calm. That’s Stage 2.

Then they expanded into new products - HEY for email, ONCE for self-hosted software - each extending the same transformation. That’s Stage 3.

Result: Premium pricing in a market where competitors race to the bottom. Competitors can copy their features. They can’t copy “calm and sane.”

Southern New Hampshire University’s path to power:

Southern New Hampshire University was a small regional school. A few hundred students. Unremarkable.

Today they serve over 130,000 students. Revenue grew from $109 million to $1.2 billion in eight years.

They started with transformation ownership: working adults moving from “poverty of aspiration” to career advancement.

President LeBlanc: “You have to be very hard-nosed about the job people are asking you to do for them, and then really optimize for that.”

They tested a commercial showing a single parent studying during a lunch break. Result: 10,000 applications in one month. Typical year: 1,000 total.

That’s Stage 1. They owned the transformation.

Then they built operations to serve it - fast admissions, personal advisors, flexible schedules. Everything designed around working adults, not traditional students. That’s Stage 2.

Then they built product leadership - best-in-class online platform, competency-based programs that let students advance as fast as they could prove mastery. That’s Stage 3.

Others serve working adults. SNHU owns the transformation.

In contrast, companies that made a big splash in years past skipped Stage 1. When their transformation story eroded, their power diminished.

Peloton thought they had Stage 1. They didn’t.

The story looked like transformation ownership: “Transform casual exercisers into fitness enthusiasts through community.” Loyal following. Devoted “Pelo-people.” $50 billion market cap at peak.

But the story was moment-based: “I can’t go to the gym.” That’s not transformation - that’s circumstance.

They built $820 million in manufacturing capacity on the assumption the moment was permanent.

When gyms reopened: Market cap collapsed from $50 billion to $4.7 billion.

The diagnostic: “Mistaking a temporary trend for a permanent societal shift, and committing funds accordingly.”

WeWork never had Stage 1.

“Create a world where people work to make a life, not just a living.” Inspirational branding. Community-focused positioning. $47 billion valuation at peak.

But coworking existed before WeWork. They were prettier execution, not transformation ownership. The model depended on low interest rates and cheap office space - moment-based, not transformation-based.

When conditions changed: valuation collapsed from $47 billion to $500 million. Chapter 11 bankruptcy.

Smart people. Billions in funding. Wrong sequence.

Ownership Creates Operational Advantage

The order you follow matters.

Here’s what this looks like in practice.

Without transformation ownership:

Monday morning starts with competitive reports. Someone shares what a competitor launched. Someone else flags a feature gap. A third person brings market research showing a trend.

Every input seems urgent. Every opportunity looks valid. The meeting becomes a debate about what to prioritize - and because there’s no governing filter, the loudest voice or the latest data wins.

You leave with a list of things to build. Your team executes. Three months later, you’re back in the same meeting, relitigating the same decisions because the new competitor move changed the calculus.

Decisions slow down. Rework piles up. You iterate - but it’s unnecessary iteration, reacting to a game defined by someone else.

With transformation ownership:

Monday morning starts differently.

Someone shares what a competitor launched. The response: “Does that serve our customer’s transformation?” If no, you ignore it. If yes, you ask: “Does it serve it better than what we’re building?” That’s a shorter conversation.

The filter is clear. Decisions move faster. You’re not chasing every opportunity - you’re capturing the right ones.

This is decision velocity.

True decision velocity is multiple decisions in one meeting. Coordination tax is multiple meetings for one decision.

Companies with transformation ownership move at opportunity speed: 3-5 decisions per meeting. Companies without it pay coordination tax: 3-5 meetings per decision. Same decisions. 10x time difference.

So where are you in the sequence?

It’s easy to assume you’re further along than you are. Most companies think they’re practicing product leadership or operational excellence when they haven’t secured the foundation.

Here’s a diagnostic to find out.

The Strategic Power Diagnostic

Answer these questions about your company, then use the prompt below to analyze your position:

What do you sell? (Your product or service in one sentence)

Who do you serve? (Your primary customer)

When a competitor makes a move, what happens? (What typically happens internally)

Why do customers choose you? (What you believe differentiates you)

How do you prioritize? (How your team decides what to build or focus on next)

How many meetings does one decision need? (Typically, for a significant prioritization decision)

What are you investing in? (Where time, money, and attention are going right now)

Copy this prompt into Claude or ChatGPT:

I want you to analyze my company’s strategic position using the Strategic Sequence framework.

Here’s the framework:

- Stage 1 (Transformation Ownership): Own the customer transformation story → creates Cornered Resource, Counter-positioning, Network Economies

- Stage 2 (Operational Excellence): Build operations that serve the transformation → creates Switching Costs, Scale Economies

- Stage 3 (Product Leadership): Build products that extend the transformation → creates Process Power, Brand

Skipping stages or practicing them out of order leads to rented positioning - competing on variables someone else defined.

Here’s my company:

WHAT WE SELL: [Your product or service in one sentence]

WHO WE SERVE: [Your primary customer]

WHEN COMPETITORS MOVE: [What typically happens internally when a competitor launches something]

WHY CUSTOMERS CHOOSE US: [What you believe differentiates you]

HOW WE PRIORITIZE: [How your team decides what to build or focus on next]

HOW MANY MEETINGS DOES ONE DECISION NEED: [Typically, how many meetings to make a significant prioritization decision]

WHAT WE’RE INVESTING IN: [Where time, money, and attention are going right now]

---

Based on this, analyze:

1. What stage am I actually practicing? (Not what I think - what the evidence suggests)

2. What strategic powers do I likely have?

3. Where am I vulnerable? (What’s missing or out of sequence)

4. What’s the one thing I should focus on first?

For each answer, include a confidence level: Low, Medium, or High - based on how much the inputs reveal.The practices and powers aren’t separate choices. They build on each other - in order.

That’s the sequence most frameworks miss. And it’s the order that positions you for advantage.

Next time you look at your strategy, don’t ask which advantage to pursue. Ask which stage you’re actually at.

Run the diagnostic. Then reply with:

What stage you’re actually at

Your biggest vulnerability

One question about what to do next

I’ll respond with specific next steps for your situation.