Viral Marketing Doesn't Compound: David Protein's Missed Positioning Opportunity

The transformation story is about your customer, not your company.

Have you ever smelled fish on a plane?

I was on a red-eye flight to visit my parents when someone two rows up opened what had to be cod. That pungent fish smell filled the cabin—the kind that just doesn’t go away no matter how much you try to ignore it. Three hours of trying to sleep while breathing fish.

So when David Protein launched their $55 frozen cod campaign, comparing protein bars to fish, it immediately caught my attention.

Not just because of my airplane trauma, but because of what it revealed about premium positioning.

Think about it: If you’re comparing protein against protein, you can’t use chicken—too common for David’s premium positioning. Beef? Nobody’s giving up a steak for a protein bar. Pork introduces dietary restrictions that alienate customers. What’s left? Seafood.

Fish codes as premium protein. It brings lobster, crab, oysters to mind—luxury foods most people don’t eat regularly. For a brand trying to position as premium protein, comparing to $55 cod makes perfect strategic sense.

But here’s where David’s premium positioning reveals a deeper problem. It isn’t just another protein bar company, but they are not leveraging their full potential.

The Mythic Arsenal David Protein Is Sitting On

Most brands start with function and climb toward philosophy. David Protein started with a legend—and somehow ended up just competing on macros.

Let me explain.

The David Archetype

The brand’s origin story begins with a boy with a sling overcoming insurmountable odds; the story of David vs. Goliath.

Most know the story isn’t about luck or divine favor—it’s about unseen preparation. Years of perfecting his aim, building quiet confidence through repetition. When the moment came, it only looked impossible because no one saw the practice. David represents disciplined preparation meeting decisive opportunity.

The Michelangelo Continuum

Centuries later, another David emerged, through the work of Michelangelo’s hands. Every strike of the chisel was an act of belief that the masterpiece was already there, waiting to be revealed.

“I saw the angel in the marble and carved until I set him free.” Excellence wasn’t built—it was uncovered by removing everything that wasn’t essential.

The Modern Heir

Today, that same ethos lives in Dr. Peter Attia’s world of longevity and performance. His work fuses both Davids—the courage to defy odds and the rigor to perfect process. His philosophy reframes optimization itself as an art form: the body as marble, the method as chisel, the outcome as proof that mastery can be engineered.

All of that—the shepherd’s preparation, the sculptor’s revelation, the scientist’s precision—lives inside the name David Protein. It’s not a brand story. It’s a mythic lineage: ordinary material transformed through disciplined design.

And yet, instead of channeling that myth into a movement, they reduced it to nutrition math. With all that built-in differentiation, they pulled themselves back into the crowd—trying to play the better game when they were born to play the bigger one.

Premium, Just Like Everyone Else

The cod comparison was clever—premium signal, instant curiosity, tactical brilliance. But clever isn’t the same as different. Once you’ve used cod, what’s next? Salmon? Lobster? You can’t scale a brand story built on seafood metaphors.

The deeper issue isn’t the fish—it’s the frame. David Protein calls itself premium in a category where everyone does. When purity becomes the default claim, price becomes the only remaining proof.

That’s the trap.

The name David already encodes aspiration—preparation meeting mastery, the marble revealing what’s within. The product design reinforces it: zero sugar, precise ratios, engineered integrity. That’s not convenience-store thinking. That’s creator thinking.

But when transformation isn’t defined, competition expands. You stop creating categories and start defending shelf space.

David Protein already owns the philosophical ground to escape the protein aisle. It can evolve from fuel for performance to fuel for creation—from premium protein bar to Creator Fuel for people who build things that matter.

The message writes itself: You are the creator of your optimal life. Here’s fuel for that creation.

The difference is existential. Competing on grams plays the better game.

Owning the mythology plays the bigger one.

David’s Lightning Strike Campaign, For the Wrong Game

Credit where it’s due: the execution was world-class. Orchestrating that Lightning Strike required real precision. The cod campaign did exactly what it was designed to do—and that’s the problem.

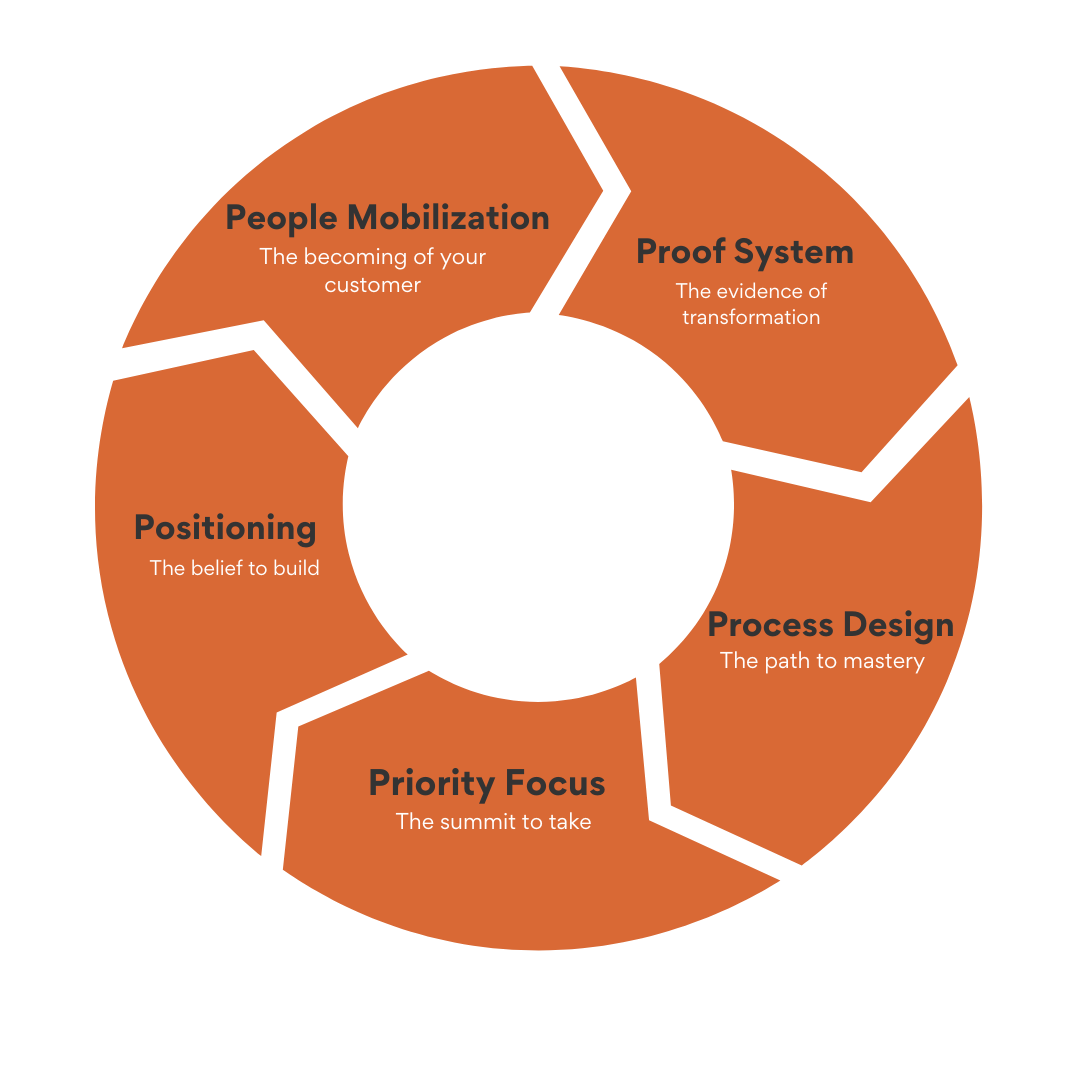

Let’s run it through the Strategy Flywheel™ to see how it performed—and where the system broke.

People Mobilization: Who was moved toward the summit?

The campaign rallied the data-driven crowd: people who optimize macros and treat nutrition like math. But there was no transformation story—no identity shift. They mobilized efficiency optimizers, not creators becoming something greater.

Proof System: What counted as evidence?

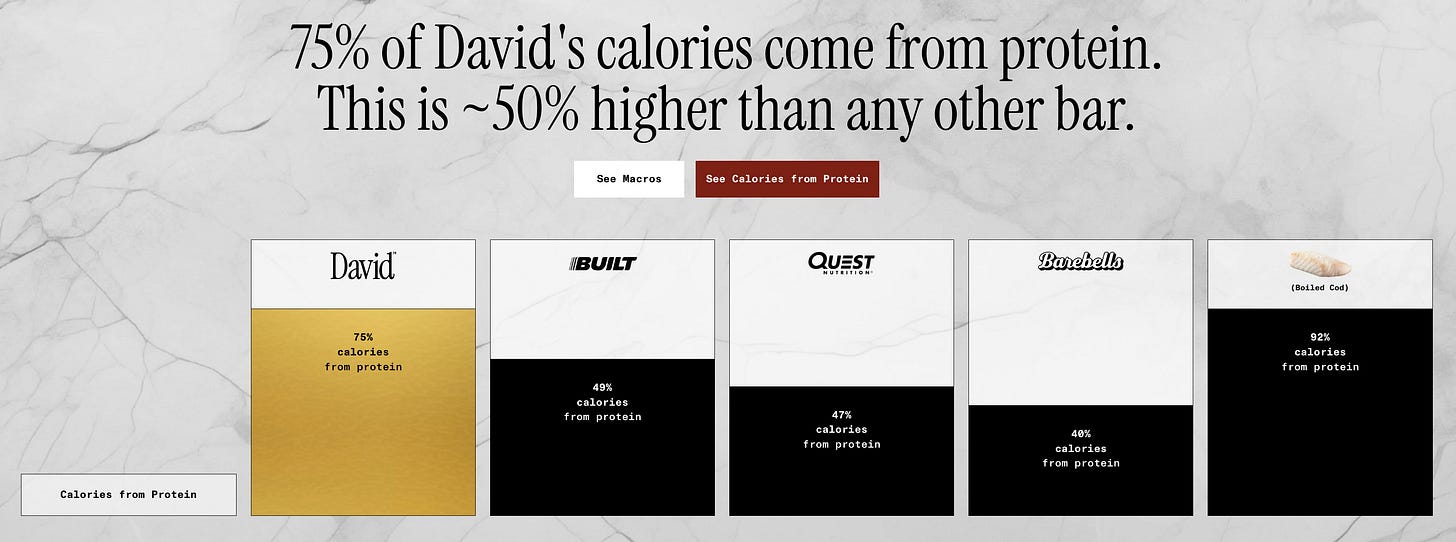

The proof was numerical: 23g protein per 100 calories (cod) versus 28g protein per 150 calories (David). Quantitative superiority. Rational, impressive, and emotionally inert. It proved a claim; it didn’t prove belonging.

Process Design: How did the motion unfold?

The sequence was strategic:

Twitter poll to set the baseline

Controversy reset to clear the noise

Teaser buildup for anticipation

Mathematical reveal for authority

Credible amplification through niche influencers

Every step built an evidence loop for the following one.

Priority Focus: What constraint drove decisions?

They optimized around a single metric: prove mathematical dominance in the protein category. Everything—content, creative, amplification—served that constraint flawlessly.

Positioning: What belief did they create?

At the end of the loop, the message was crystal clear: if protein efficiency is the game, David wins.

And that’s precisely the miss.

They built an elegant proof engine for the wrong game. Every element functioned perfectly inside a frame that made them indistinguishable from the competition.

When you start from a name that symbolizes mastery revealed through discipline, you don’t need to prove you’re better protein.

You need to prove you’re Creator Fuel.

They played to win the moment. They could have played to redefine the field.

David’s Prime Positioning Opportunity: Creator Fuel for Optimal Life

Look at what David already possesses: mathematical precision (the cod proof), artisan heritage (Michelangelo’s David), and engineering discipline (systematic nutrition design). Those aren’t protein-bar features—they’re Creator Fuel foundations.

With that framing, David stops selling to fitness enthusiasts and starts energizing creators. Entrepreneurs optimizing work performance. Parents engineering family vitality. Artists fueling long sessions. Professionals designing optimal routines.

Now it’s not “better protein for gym people.” It’s fuel for anyone building their optimal life.

That single shift changes everything.

When someone designs their day for peak performance, they might grab a Snickers, an energy drink, or coffee. David becomes the alternative—the one aligned with creation, not consumption. “You’re building your optimal life. This is the fuel for that creation.”

Suddenly the Michelangelo heritage resolves perfectly: sculpting excellence from raw material, revealing what already exists within.

The Fitness Food Precedent:

If that sounds ambitious, remember what happened with creatine.

This summer, Dr. Rhonda Patrick reframed creative on Diary of a CEO. Once a “gym bro” supplement, it became a cognitive enhancer for high-performing professionals—muscle fuel reinterpreted as mental fuel.

In a single conversation, a commodity product earned cultural permission to enter boardrooms and creative studios as a replacement for afternoon coffee.

Now imagine David doing the same.

With Dr. Peter Attia gaining traction in mainstream media, David could ignite another lightning strike—not around protein efficiency, but around sustained cognitive performance.

From convenience to craftsmanship. From macros to mastery.

From fuel for fitness to fuel for creation.

The story’s ready. The heritage is built. The audience is waiting.

All that’s missing is the decision to play the bigger game.

What David’s Creator Fuel Position Opens Up

“Creator Fuel for the Optimal Life” isn’t just a tagline—it’s a campaign architecture.

A full-year system that converts one-off virality into sustained cultural relevance.

Instead of one-off viral moments, they could build campaigns around every aspect of optimal living: ‘Creator Fuel for Optimal Morning Routines,’ ‘Creator Fuel for Optimal Work Focus,’ ‘Creator Fuel for Optimal Recovery,’ ‘Creator Fuel for Optimal Travel Energy.’

An example year with this positioning:

Q1: Launch the Creator Fuel narrative—precision as philosophy.

Q2: Collaborate with visual artists, musicians, and writers—fuel for creative flow.

Q3: Partner with entrepreneurs and builders—fuel for focused execution.

Q4: Unite disciplines in a Creator Collective—fuel for cross-domain mastery.

Every campaign reinforces the shift from “I buy premium protein bars” to “I fuel my creativity.”

That’s more than a transaction. It’s identity integration. Once people see themselves as creators, you aren’t worried about shelf space.

What This Means For Strategic Thinkers

Tactics win moments. Systems win markets.

David’s Lightning Strike proved tactical precision. But viral excellence without narrative expansion keeps you trapped inside someone else’s frame.

The higher game is sequence design—using proof of performance to architect belief over time. That’s how you evolve from campaign to category.

Now zoom out.

Are you sitting on strategy gold—and not using it?

If you’re in a fierce category battle, ask yourself: what territory do you already own but haven’t claimed? What philosophy sits dormant in your brand, waiting to be named?

The greatest strategic advantage isn’t playing harder—it’s defining the field others have to enter.

David proved they can execute with precision. Now they have to prove they can think with altitude.

The question isn’t whether they can keep winning in premium protein. It’s whether they’ll seize Creator Fuel while it’s still unclaimed.

Build the category only you can define. And reap the benefits of Prime Positioning.

How This Synthesis Happened: Strategic Thinking at AI Speed

I structured AI research through the Strategy Flywheel, mapping David’s mythic brand heritage versus premium positioning constraints, the cod campaign tactical execution and competitive dynamics, category positioning opportunities versus protein aisle competition, and Creator Fuel territory potential.

Without strategic structure, I would have gathered scattered intelligence — campaign engagement metrics, protein industry data, premium positioning case studies, competitor messaging analysis, mythic symbolism research — with no strategic coherence.

David executed brilliant Lightning Strike tactics while missing Prime Positioning territory that could redefine the category—an insight requiring simultaneous coordination of mythic heritage assets, premium category limitations, Creator Fuel opportunity space, and identity transformation potential.

Connecting “$55 cod campaign viral success” to “missed Creator Fuel category creation opportunity” required what AI still cannot supply: trained judgment that works backwards from business outcome to architecture.

AI compressed the timeline. Strategic synthesis came from human judgment: mythic positioning beats premium competition.

The cod campaign was brilliant tactics.

But brilliant tactics deployed on the wrong strategic terrain still miss the mark.

Let’s step inside the strategy itself.

The following analysis is based entirely on publicly available information—social media content, press coverage, and marketing materials. It serves as an educational demonstration of strategic reasoning, not investment advice.

The author holds no current affiliation or financial relationship with David Protein and may, at a future point, consider investment or advisory opportunities with companies featured.

[ENTERING THE OWNER’S BOX]

DAVID PROTEIN

Creator Fuel for Optimal Life vs. Premium Protein Bars

EXECUTIVE SUMMARY

Core Thesis

David Protein’s current positioning as “premium protein bars with mathematical superiority” follows an inverted power sequence - attempting Product Leadership without Customer Intimacy foundation. This creates vulnerability to competitive spec-matching within 12-18 months (MEDIUM confidence).

Strategic Opportunity: Repositioning to “Creator Fuel for Optimal Life” establishes Customer Intimacy through identity integration across multiple lifestyle optimization categories. This transcends protein bars entirely, claiming territory where competitors cannot follow due to brand DNA conflicts (HIGH confidence on competitor barriers, MEDIUM confidence on execution).

The Two Paths

Path A: Premium Protein Bar Positioning (Current)

Market: $2.1-2.8B premium protein bar segment (1) - Official industry reports

David potential: 5-8% share = $100-240M revenue ceiling (3) - Modeled based on premium player precedents

Timeline: 12-18 months to margin compression as competitors match specs (MEDIUM confidence)

Outcome: Successful premium player, likely CPG acquisition at $300-500M valuation (3) - Based on RXBar $600M precedent, adjusted for scale

Path B: Creator Fuel for Optimal Life (Proposed)

Market: $85-150B lifestyle optimization category (3) - Modeled TAM expansion, see analysis below

David potential: 2-5% category leadership = $1.7-7.5B revenue potential (3) - Modeled based on lifestyle brand precedents

Timeline: 24-48 months to category consolidation (MEDIUM confidence)

Outcome: Category creator, venture-scale outcome $3-8B valuation potential (LOW confidence - execution-dependent, but order of magnitude difference vs. Path A

Critical Time Horizon

6-9 month window to reposition (MEDIUM confidence) before:

Brand perception solidifies around “premium protein bars” (6-12 month typical brand association timeline)

Competitors complete EPG alternative development (9-15 month R&D cycle)

Retail distribution locks into fitness channel (12-18 month category management cycles)

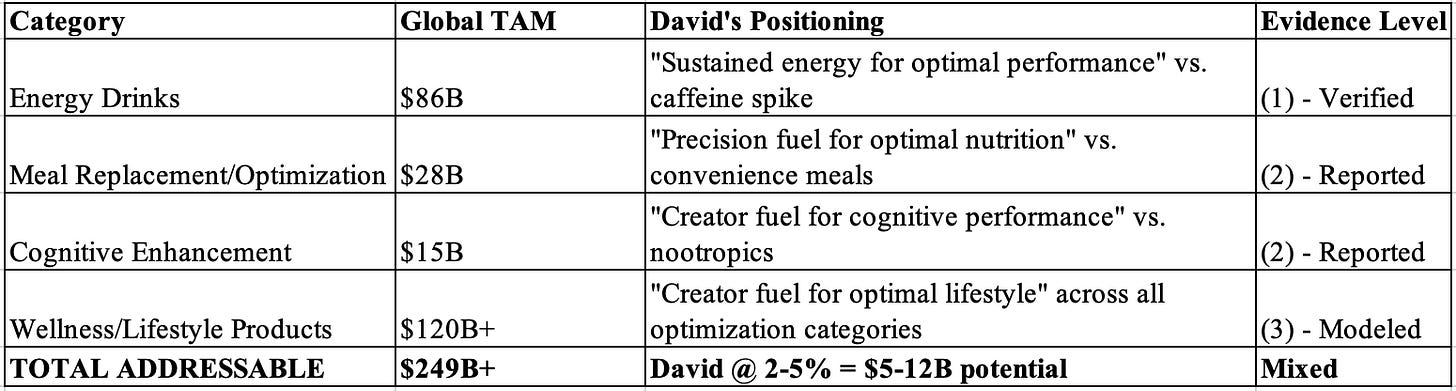

CATEGORY REDEFINITION ANALYSIS

The Life Optimization Mega-Category

“Creator Fuel for Optimal Life” positions David to compete against anything people consume while creating their optimal life - not just protein bars. This includes energy drinks, meal replacements, cognitive supplements, productivity aids, and optimization tools across multiple categories.

TAM Expansion Analysis

Customer Expansion: Beyond “Creators of Consequence”

“Creator Fuel for Optimal Life” targets anyone creating their optimal life, dramatically expanding addressable customers:

Entrepreneurs optimizing work performance (15M+ in US alone)

Parents creating optimal family energy and routines (25M+ households)

Artists and creative professionals fueling creative sessions (5M+ active creators)

Professionals building optimal daily routines (50M+ knowledge workers)

Health-conscious individuals optimizing lifestyle choices (75M+ in optimization mindset)

Total Addressable: 100M+ people vs. the previous “creators of consequence” segment of ~5-10M systematic thinkers.

(3) - Modeled based on lifestyle category participation rates

POWER STACK ANALYSIS

David Protein: “Creator Fuel for Optimal Life”

Current State: Inverted Power Sequence

Value Discipline Assessment: Product Leadership (attempting superior product specs as primary differentiator)

Evidence: 28g protein, 150 calories, 0g sugar - marketed as “mathematically superior”

Evidence: Cod campaign comparing protein-per-calorie ratios

Strategic Error: Building Product Leadership without Customer Intimacy foundation

Repositioned State: Creator Fuel for Optimal Life

CUSTOMER INTIMACY: ✅ TRANSFORMATIONAL OPPORTUNITY

Network Economies: ✅ LIFESTYLE COMMUNITY FORMATION

Assessment: “Creator Fuel” users create value for other lifestyle optimizers through sharing routines, progress, and optimization discoveries

Mechanism: Community platform where people share “How I’m creating my optimal life” + fuel choices

Network effects: More lifestyle optimizers → more optimization strategies shared → higher value for all participants

Precedent: MyFitnessPal network effects, Strava social fitness, AG1 community sharing (2) - Similar platforms demonstrate network value creation

Confidence: HIGH - lifestyle optimization inherently benefits from community learning

Switching Costs: ✅ IDENTITY-BASED INTEGRATION

Assessment: “I am someone who creates my optimal life” becomes core identity, David becomes integrated into daily optimization routine

Switching cost mechanisms:

Identity integration: “This is who I am” vs. “This is what I use”

Routine optimization: David integrated into morning routines, work fuel, recovery protocols

Progress tracking: “My optimal lifestyle journey includes precision fuel”

Social signaling: “I fuel with precision because I create consequential outcomes”

Confidence: HIGH - identity-based switching costs are strongest form (AG1, Apple ecosystem precedents)

Counter-Positioning: ✅ MASSIVE STRUCTURAL ADVANTAGE

Assessment: “Creator Fuel for Optimal Life” territory is unclaimed and un-claimable by existing players

Why competitors CANNOT follow:

Quest: Mass-market “fitness for everyone” DNA conflicts with artisan/precision/creator identity

RXBar: “No B.S.” whole-food transparency conflicts with “precision engineering” positioning

Energy drinks: Cannot claim “optimal lifestyle” due to addiction/stimulant association

Meal replacements: Convenience/efficiency positioning conflicts with artisan/creator heritage

David’s unique assets: Michelangelo creator archetype + mathematical precision + premium positioning + systematic thinking credibility (Attia/Huberman)

Confidence: HIGH - classic counter-positioning where response would damage incumbents’ core business

Product Line Architecture Revolution

“Creator Fuel for Optimal Life” unlocks multi-category expansion where each product reinforces creator identity:

Morning Optimization: “Creator Fuel for Optimal Morning Routines” - breakfast replacement, cognitive prep

Work Performance: “Creator Fuel for Optimal Focus” - sustained cognitive energy, deep work fuel

Recovery Optimization: “Creator Fuel for Optimal Recovery” - sleep quality, muscle recovery, stress management

Travel/Mobility: “Creator Fuel for Optimal Travel Energy” - jet lag mitigation, on-the-go optimization

Social/Family: “Creator Fuel for Optimal Presence” - sustained energy for family time, social optimization

Each category expansion reinforces core identity: “You are creating your optimal life, here’s fuel for that creation.”

COMPETITIVE LANDSCAPE - LIFE OPTIMIZATION TERRITORY

Why Traditional Competitors Cannot Claim This Territory

Energy Drinks: Red Bull, Monster, etc.

Cannot Claim “Optimal Life”: Brand DNA fundamentally conflicts

Association: Quick hits, caffeine dependence, artificial stimulation vs. sustained optimization

Brand heritage: Extreme sports, party culture, youth energy vs. thoughtful lifestyle creation

Customer perception: “Energy drinks are what you use when you haven’t optimized your lifestyle”

Cannot pivot: “Red Bull for Optimal Lifestyle” would alienate core base and lack credibility with optimization community

(HIGH confidence - brand DNA analysis)

Meal Replacement: Soylent, Huel, etc.

Cannot Claim “Creator Fuel”: Positioning conflicts with creator identity

Current positioning: Efficiency, convenience, “fuel for people too busy to eat”

Creator identity requires: Artisan approach, precision, “fuel for people creating important work”

Heritage: Tech optimization, biohacking, minimal viable nutrition vs. artisan precision fuel

Cannot pivot: Soylent cannot credibly claim Michelangelo creator heritage or artisan precision positioning

Wellness Brands: AG1, Athletic Greens category

Closest Competitive Threat but territory differentiation possible:

AG1 positioning: “Foundational nutrition for high performers”

David positioning: “Creator fuel for optimal lifestyle builders”

Differentiation: AG1 = foundational health, David = creative/productive fuel

Occasions: AG1 for daily foundation, David for creation sessions, work fuel, lifestyle optimization

Complementary not competitive: “I take AG1 for foundation, David when I’m creating”

(MEDIUM confidence - may require testing to validate differentiation)

STAKEHOLDER ACTION FRAMEWORK

FOR DAVID PROTEIN: The 24-Month Lifestyle Category Creation Playbook

Phase 1: Foundation (Months 0-6) - Identity Transformation

Critical Decision (Next 90 Days): Choose Creator Fuel for Optimal Lifestyle vs. Premium Protein Bars

Messaging Transformation (Week 1-4):

Kill: “28g protein, mathematically superior to cod”

Launch: “You are the creator of your optimal life. Here’s fuel for that creation.”

Campaign: “What are you creating today?” - show people in the process of creating optimal routines, optimal work, optimal health

Michelangelo activation: “Michelangelo didn’t fuel on empty calories while creating David. What are you creating?”

Community Infrastructure Launch (Month 2-6):

Platform: “Creators of Optimal Life” collective

Content: Members share optimization routines, progress, fuel strategies

Social proof: “People creating optimal lives fuel with precision”

Network effects: More optimizers → more strategies shared → higher value for all

Phase 2: Category Expansion (Months 6-18) - Multi-Product Lifestyle Platform

Product Line Rollout:

Month 6: “Creator Fuel for Optimal Morning Routines” - breakfast optimization line

Month 9: “Creator Fuel for Optimal Focus” - cognitive performance during work

Month 12: “Creator Fuel for Optimal Recovery” - sleep/stress optimization

Month 15: “Creator Fuel for Optimal Travel” - on-the-go lifestyle maintenance

Distribution Strategy:

Target: Lifestyle optimization contexts, not fitness retail

Locations: Coworking spaces, wellness centers, premium coffee shops, optimization-focused retailers

Partnerships: Meditation apps, productivity platforms, wellness programs

Phase 3: Category Leadership (Months 18-36) - Life Optimization Ecosystem

Ecosystem Integration:

Platform partnerships: Integration with habit tracking, productivity apps, wellness platforms

Data integration: “Your optimal fuel recommendations based on your optimization goals”

Community scale: 1M+ lifestyle optimizers sharing strategies and fuel choices

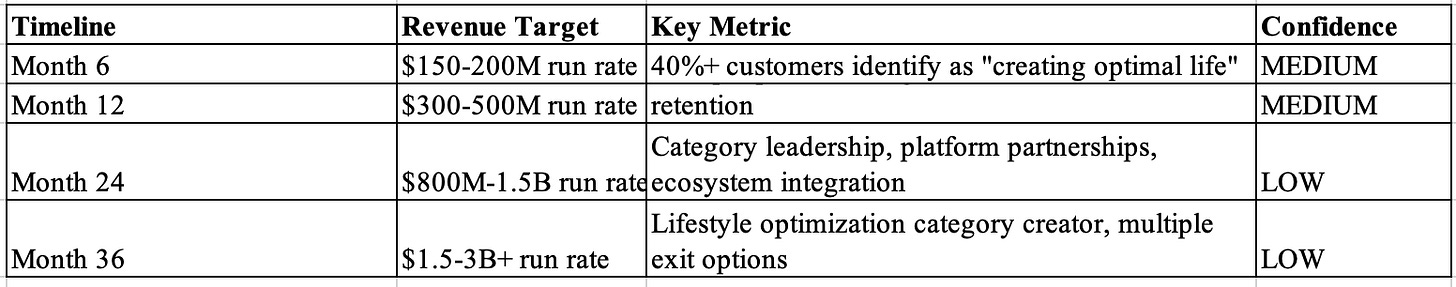

Success Metrics & Timeline

WHAT WOULD CHANGE MY MIND - FALSIFICATION CRITERIA

Core Thesis Falsification

Core thesis: “Creator Fuel for Optimal Life” positioning creates 10-30x better outcomes than premium protein bar positioning through lifestyle category creation.

I would revise this assessment if:

1. Identity Integration Fails (Evidence by Month 6)

Falsifying Evidence:

Brand tracking: <25% of customers associate David with “creating optimal life” despite 6 months of messaging

Customer surveys: <30% self-identify as “lifestyle optimizers” (vs. 50%+ target)

Retention: No improvement over protein bar baseline (40-50% vs. 70%+ target)

Social proof: <20 organic “optimal lifestyle” posts without payment

Alternative Hypothesis: “Creator fuel for optimal lifestyle” is too abstract/aspirational; people don’t identify with lifestyle optimization framing.

2. Category Expansion Doesn’t Work (Evidence by Month 12)

Falsifying Evidence:

Product extensions fail: Morning optimization, focus products generate <10% of revenue

Customers view new products as separate brands not cohesive lifestyle platform

Revenue growth: 20-30% YoY (protein bar category pace) vs. 100%+ category expansion target

Alternative Hypothesis: “Creator fuel” positioning works for bars but doesn’t extend across lifestyle categories; consumers compartmentalize nutrition vs. broader optimization.

3. Competitors Successfully Pivot (Evidence by Month 18)

Falsifying Evidence:

AG1 launches “AG1 for Creators” and captures 30%+ of lifestyle optimization category

New well-funded entrant claims “optimal lifestyle fuel” territory successfully

Energy drink players launch credible “sustained optimization” lines

Alternative Hypothesis: Counter-positioning barriers aren’t as strong as assessed; lifestyle optimization category is attackable by existing players with sufficient resources.

CONCLUSION: THE CHOICE

The strategic choice facing David Protein is not “better protein bars” vs. “different protein bars.” It’s category competition vs. category creation.

Path A (Premium Protein Bars): 70% probability × $300-500M outcome = ~$250M expected value

Path B (Creator Fuel for Optimal Life): 40% probability × $3-8B outcome = ~$2B expected value

Expected Value Analysis: Path B has 8x higher expected value despite execution risk.

David has unique assets no competitor can replicate:

Michelangelo heritage (ultimate creator archetype)

Mathematical precision capability (systematic thinking signal)

Premium positioning (price-positioned for identity value)

Systematic thinking credibility (Attia/Huberman backing)

Proven viral marketing capability ($100M Year 1)

The Window: 6-9 months to reposition before brand perception solidifies and opportunity closes.

The Recommendation: If David seeks venture-scale outcome and can execute identity transformation, choose Path B: Creator Fuel for Optimal Life.

The ultimate question isn’t whether David can compete in protein bars (proven: $100M Year 1).

The question is whether David will claim the lifestyle optimization category their assets uniquely position them to create.

That’s the strategic choice.

Want Your Strategy Under the Microscope?

If you’d like your company analyzed through the same Prime Positioning lens—or you’re ready to architect your own clarity loop—reply to this post.