Daisy Defense: How O2 Accidentally Created a Category (And What They Should Do Next)

How the strategy of going on offense creates prime positioning in defensive markets

Imagine you’re sitting at your kitchen table on a Sunday morning, coffee getting cold, laptop open to your banking app. Holiday shopping budget planned, everything organized.

Then you refresh the screen. $0.00.

Your heart stops. You refresh again. Still zero. Three days of workshops last week - you were in conference rooms in Chicago, not beaches in the Caymans. But there’s the charge. $2,812 to some resort you’ve never heard of.

The rage hits immediately. Some stranger just stole your Christmas. Your family’s presents. Your January rent money.

Now imagine you could fight back. Not just get your money returned after weeks of bank investigations and police reports. Actually hunt down the person who did this to you. Waste their time. Expose their tactics. Make them rue the day they picked your number.

That’s exactly what Daisy Defense does to scammers - and she’s incredibly good at it.

What O2 built—almost accidentally—created an entirely new category: Conversational Honeypots. And in doing so, they claimed strategic territory their competitors still don’t understand.

The Innovation Constraint That Created Category Territory

O2’s breakthrough to Conversational Honeypots started with one insight: the defenses were working, but customers still felt hunted.

By 2024, O2 had built one of the strongest anti-scam infrastructures in Europe — AI systems flagging tens of millions of suspicious calls each month, Brand ID reducing impersonation risk, and Call Defense intercepting high-risk numbers before they reached the public.

Technically, the perimeter held. Emotionally, it didn’t. Customers were still living on alert.

The breakthrough came when leadership reframed the problem. Instead of asking how to build better walls, they asked what would happen if O2 crossed the line and took the fight to the scammers. For a company built around “essential for life,” this was more than a tactic shift — it was a return to first principles. Essential services don’t just shield; they neutralize.

That reframing produced a single governing constraint: every action must make scammers less effective and customers more empowered. This became the filter for resource allocation, product development, and partner strategy. Competitors optimized around network reliability, pricing, or global reach. O2 optimized around power inversion.

Under that constraint, the work changed. Engineering didn’t just improve detection — it built AI capable of wasting scammer time and extracting intelligence. Marketing didn’t just warn consumers — it mobilized them. Customer protection stopped being passive defense and became active disruption.

That constraint made Daisy Defense possible: Conversational Honeypots that flip the power dynamic so completely that scammers waste their time, their scripts, and their psychological leverage on an AI opponent designed to absorb it all.

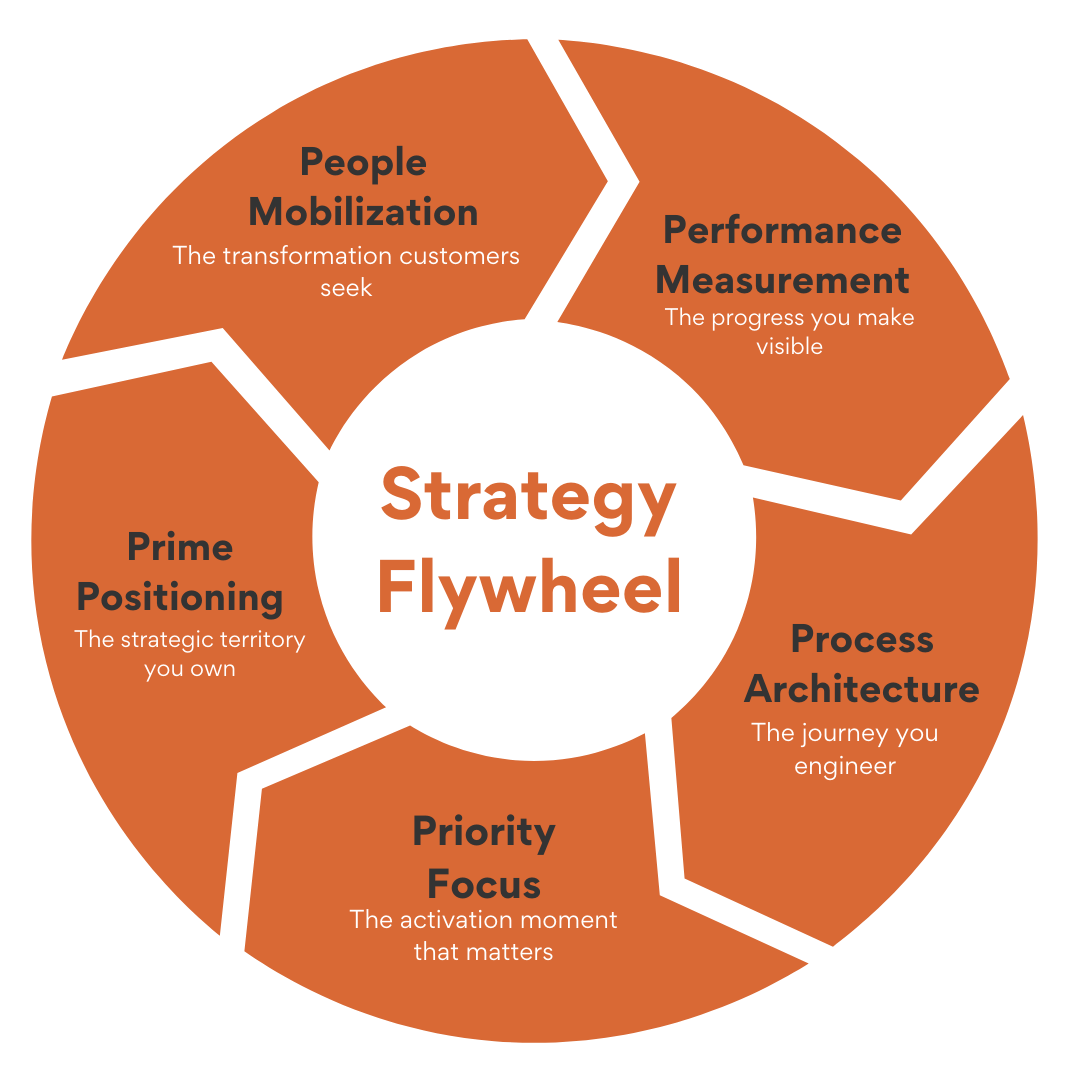

How O2 Operationalized The Constraint Through The Strategy Flywheel™

1. PEOPLE MOBILIZATION — The Identity Shift That Created Strategic Territory

The Conversational Honeypot breakthrough started with a psychological insight competitors couldn’t access: customers didn’t want better protection—they wanted someone fighting back on their behalf.

That distinction created the strategic opening.

Every other telecom positioned around defensive capability.

“We block more calls.”

“We detect fraud faster.”

“We protect your data better.”

All variations of the same promise: we’ll build higher walls.

O2 saw different territory entirely. Instead of promising better defense, they offered offense. Instead of “we’ll protect you,” they delivered “we’ll hunt them.”

That insight became Daisy Defense—O2’s implementation of Conversational Honeypots that positioned customers as the counterforce, not the target.

2. PERFORMANCE MEASUREMENT: Validating Strategic Territory, Not Just Product Performance

Category claims demand a different proof threshold than product claims.

Product proof answers a narrow question: does the feature function as intended?

Category proof answers the only question that matters: does the market acknowledge new territory exists—and that you own it?

O2 wasn’t validating Daisy’s technical competence. That was table stakes. They were validating whether Conversational Honeypots was crystallizing as a category frame the market would repeat without prompting.

When customers referred to Daisy as ‘the AI granny’ instead of a scam-blocking tool, a mental model shifted. They weren’t describing a feature—they were naming a new category through character, not capability.

When media coverage moved from “O2 builds a chatbot” to “O2 fights back against scammers,” the frame detached from product and attached to territory.

Timing accelerated the lock-in.

Launching into the Black Friday–Christmas–New Year scam spike meant audiences were already primed for threat-framing. If O2’s language held during the highest-alert season of the year, the category would transition from novelty to default interpretation.

This is a different validation standard entirely. Call duration proves Daisy works. Scammer frustration proves the persona holds. But category language adoption proves something larger: competitors must now reference O2’s frame, not attempt to replicate O2’s feature.

The measurement shift is simple and absolute: From “how well does our AI perform?” to “how quickly does the market repeat our strategic language?”

3. PROCESS ARCHITECTURE — The Operating Rhythm That Turns Features Into Defended Categories

Most companies build features and hope they become categories. O2 built the operating rhythm that makes category defense systematic.

The difference lies in understanding what customers are actually transforming into, not just what problem they’re solving.

Scam victims don’t just want fewer fraudulent calls. They want to stop feeling hunted. That transformation - from hunted to represented - became the anchor for everything O2 built. Without that clarity, Daisy would have been a clever chatbot. With it, Daisy became the proof point of an entirely new customer identity.

Here’s the operating rhythm that makes this repeatable:

Customer Transformation Mapping

O2 identified the exact psychological shift customers needed (victim → counterforce) and designed every interaction to reinforce that identity change.

Proof Architecture Design

They built measurement systems that validated identity transformation, not just technical performance. The question wasn’t “does Daisy work?” but “do customers feel represented?”

Market Language Engineering

They seeded Conversational Honeypot terminology through earned media, customer conversations, and competitive positioning until the market adopted their framing.

Decision Velocity Acceleration

Clear customer transformation understanding enabled faster, more confident moves. When you know customers want to become the counterforce, building offensive capabilities becomes obvious.

This rhythm - transformation clarity → proof architecture → language seeding → accelerated decisions - is what turns features into categories.Without understanding the customer transformation, you’re optimizing for the wrong summit.

With it, you’re building competitive advantage at opportunity speed.

4. PRIORITY FOCUS — The Constraint That Forces Innovation While Competitors Optimize

O2’s constraint forced different thinking entirely. Instead of “how do we block more efficiently?” they asked, “what if we went on offense?”

That question became the innovation engine. And revealed the competitive trap.

Competitors couldn’t replicate without strategic repositioning they couldn’t afford. Vodafone can’t suddenly start “hunting scammers” without confusing customers who expect them to “protect networks.” EE can’t shift from “reliable connectivity” to “customer representation” without undermining years of positioning investment.

But O2’s “essential for life” positioning gave them permission to escalate. The constraint aligned with their brand promise instead of contradicting it.

That’s why the constraint became an advantage.

The result: O2 claimed Conversational Honeypot territory through innovation constraint while competitors remained trapped in optimization constraint.

5. PRIME POSITIONING — The Belief Architecture That Creates Lightning Strike Opportunities

None of this machinery works without the belief architecture to justify it.

O2 wasn’t positioned as a telecom experimenting with AI chatbots. They were positioned as a company whose brand promise—’essential for life’—gave them the authority to go on offense on behalf of customers.

Prime Positioning reframed the work: O2 wasn’t “blocking scams.” They were deploying Conversational Honeypots.

This belief gave the system integrity. It allowed the offensive move to be interpreted as protective, not aggressive. And it prepared O2 to claim territory their competitors didn’t see forming.

But the real strategic power emerged in what this positioning enabled: expansion into any market where customers feel victimized.

Financial Sector Lightning Strikes

Every banking fraud headline becomes an Daisy Defense moment. When customers lose savings to sophisticated scams, the natural question becomes “why didn’t banks hire AI Granny?” The same permission architecture that justified telecom offense justifies banking offense.

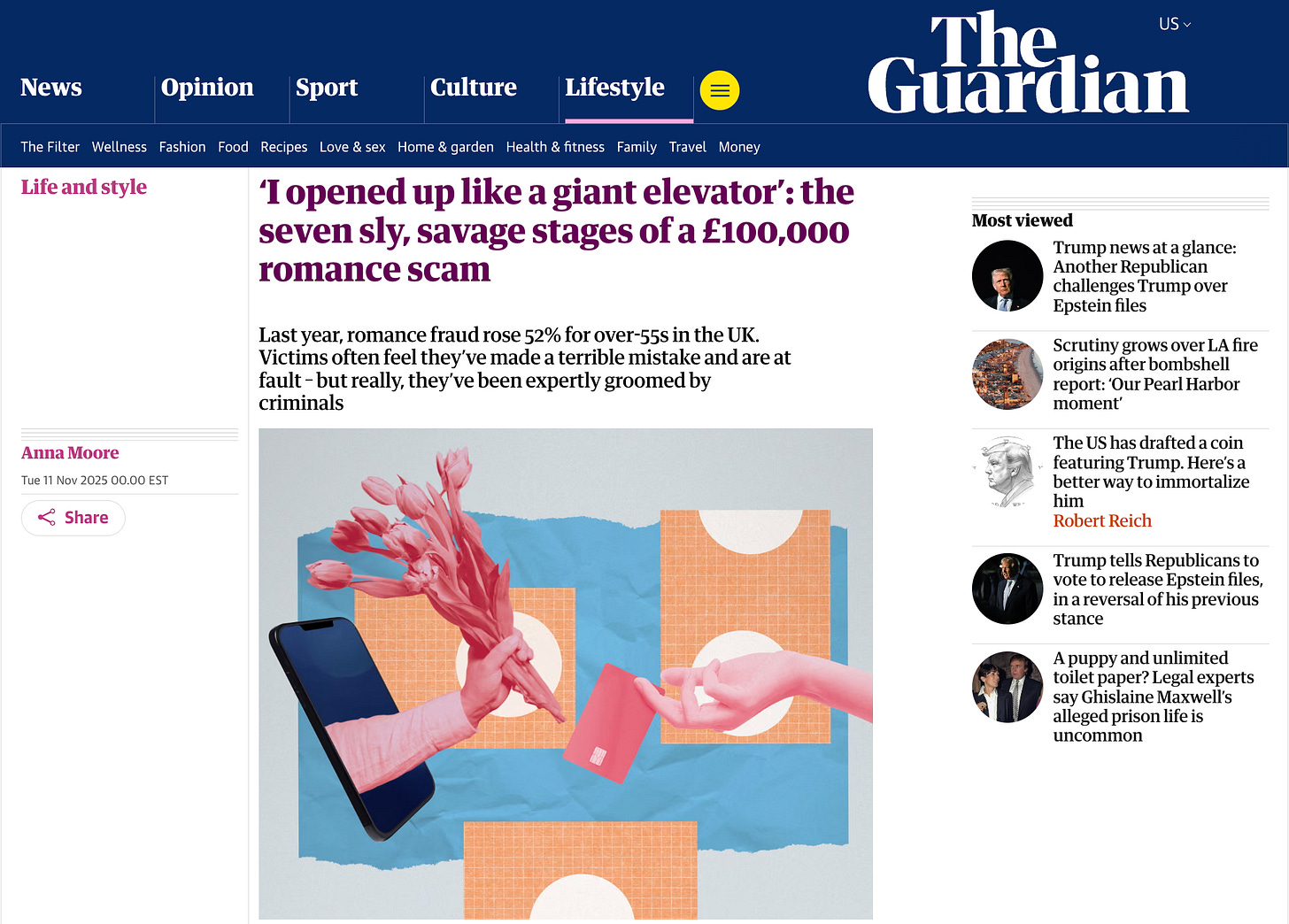

Romance Scam Opportunities

Dating platform breaches or romance fraud exposés create instant market openings. “Essential for life” includes emotional safety. When stories break about victims losing life savings to fake profiles, Daisy Defense becomes the obvious prevention solution platforms should have deployed.

Enterprise Security Moments

Corporate email compromise costs billions annually. Every high-profile breach generates the same response: “Conversational Honeypots could have caught this before it reached humans.” The positioning transfers seamlessly from consumer protection to corporate protection.

Government Fraud Activation

Tax season, benefit fraud investigations, immigration scams—each creates natural lightning strike opportunities. “Essential for life” services include protection from government impersonation.

The strategic result: every negative fraud story in any industry becomes an Daisy Defense opportunity. Competitors don’t have this systematic advantage because they don’t own Conversational Honeypot territory.

When the next major scam headline breaks, markets won’t ask “how do we build better defenses?” They’ll ask “why didn’t we deploy Daisy Defense?”

That’s how Prime Positioning turns crisis moments into category expansion opportunities.

How Closed Markets Become Opportunity-Rich

O2 broke through in one of the most saturated, regulated, price-compressed markets in the world. UK telecom isn’t just competitive—it’s structurally hostile to differentiation.

Yet they created a moment that cut cleanly through the noise.

The remarkable thing about O2’s breakthrough wasn’t that they engineered it through years of strategic planning. They stumbled into Conversational Honeypots by following a simple constraint—make scammers less effective—and then had the strategic clarity to recognize the category they’d accidentally created.

That’s the pattern worth replicating: most category creation looks accidental from the outside, systematic from the inside. O2’s constraint gave them permission to experiment. Their Strategy Flywheel gave them the structure to recognize what they’d built.

The diagnostic framework that emerges:

4 Diagnostic Questions That Reveal Hidden Territory

1. Transformation Clarity: What identity shift do your customers actually need?

Not what they say they want, but who they’re trying to become. O2 discovered customers didn’t want better protection—they wanted to stop feeling hunted.

2. Competitive Blindness: What aspect of that transformation is your industry underselling?

Every telecom promised better defense. None offered representation in the fight.

3. Assumption Audit: What operational convention hasn’t been questioned in years?

The assumption that telecoms must be defensive, not offensive, hadn’t been examined. It was just accepted.

4. Lightning Strike Readiness: Can you move from insight to execution before competitors understand what territory you’re claiming?

Decision velocity becomes the competitive advantage when you see openings others don’t.

Transformation clarity reveals competitive blindness, which exposes unquestioned assumptions, which creates lightning strike opportunities.

O2 demonstrated the pattern. The same pattern is available to any strategy leader capable of questioning what everyone else assumes.

How the Strategy Flywheel™ + AI Acceleration Revealed Prime Positioning Insights

I structured AI research through the Strategy Flywheel, mapping O2’s brand heritage and mythic “Essential for Life” positioning, the Daisy campaign mechanics and scammer engagement data, telecom competitive dynamics across EE/Vodafone/Three, and category expansion pathways into banking, dating, enterprise, and government sectors.

Without strategic structure, I would have gathered scattered intelligence—campaign metrics, AI voice technology specs, regulatory filings, competitor marketing spend, customer sentiment data—with no strategic coherence.

O2 created the Conversational Honeypot category by inverting power dynamics rather than improving defenses—an insight requiring simultaneous coordination of commodity telecom constraints, customer victimization psychology, AI deception infrastructure capabilities, and untapped category expansion opportunities across fraud-adjacent industries.

Connecting “Daisy wastes scammer time” to “billion-dollar Daisy Defense licensing platform across financial services and government agencies” required what AI cannot supply.

AI compressed the timeline. Strategic synthesis determined the outcome: offensive positioning beats defensive feature competition.

Most stop at the diagnosis. The strategic response is harder: recognizing when you’re O2—holding Conversational Honeypots territory while competitors remain trapped in defensive positioning—versus when you’re the competitor trying to cross the offensive moat.

The pattern is visible. The application is not.

The following strategic analysis is based solely on publicly available information, including social media posts, press coverage, and marketing campaigns. It represents an educational exploration of strategic thinking methodology and does not constitute investment advice. The author has no business relationship with O2 and may, in the future, consider potential investment or advisory opportunities with companies analyzed.

[ENTERING THE STRATEGY WAR ROOM]

O2: CONVERSATIONAL HONEYPOTS

The Accidental Category Creator That Systematized Offensive Defense

How constraint-following leads to billion-dollar infrastructure opportunities

EXECUTIVE SUMMARY

O2’s “Conversational Honeypots” category creation violates conventional telecom Value Disciplines sequencing by accidentally discovering Customer Intimacy through systematic constraint-following while competitors remain trapped in defensive feature optimization.

Net effect: O2 claims “Daisy Defense” infrastructure territory within 6-12 months as market recognizes systematic offensive methodology superiority over defensive point solutions, creating 15-25x category expansion opportunity in global fraud prevention infrastructure market worth £35-50B+ annually (3).